- But it will take years to return to full production

Hear Simon Flowers once again

Stable crude oil prices over the last 18 months are a good measure of the success of the OPEC+ strategy to defend price. Brent has mostly traded in a tight range around US$80/bbl – with the occasional breach into the low US$90s – since OPEC+ began to reduce supply in Q4 2022. That’s despite intense geopolitical uncertainty with war raging in Ukraine and Gaza, and heightened tensions in the Middle East.

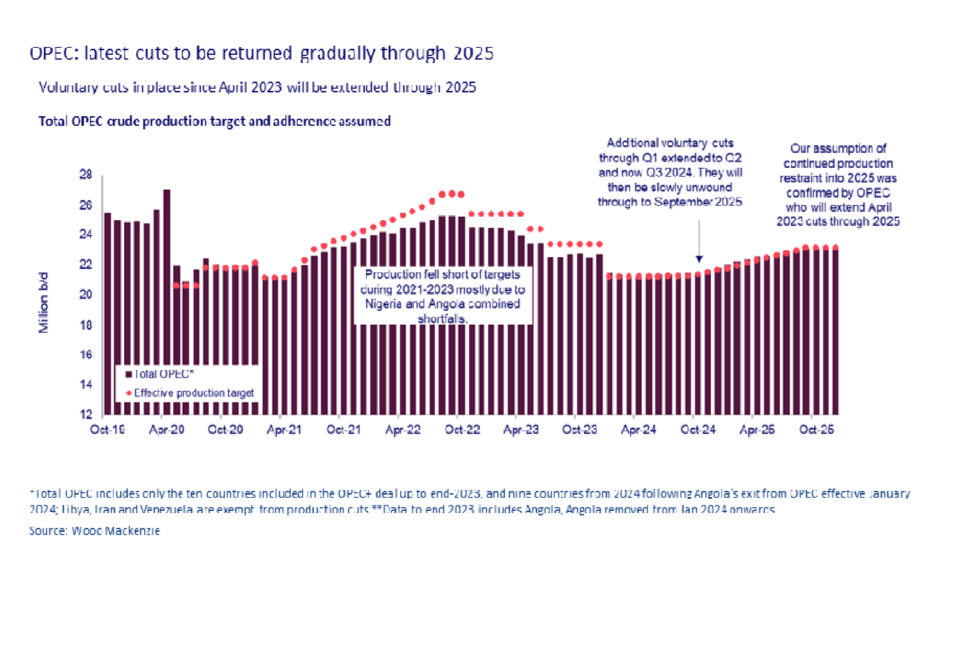

Early this month, OPEC+ announced that the strategy is poised to move into reverse later this year, as we anticipated in February. The intention is to start releasing volumes from one set of voluntary supply cuts starting in October. Based on our analysis of supply and demand, a window is opening to absorb more OPEC+ oil.

Ann-Louise Hittle, Head of Macro Oils, talked me through her team’s thoughts.

First, OPEC+ needs oil demand to continue to grow if it’s to sell more oil without denting price

The immediate outlook is promising. After slipping to under 84 million b/d at the pandemic low in Q2 2020, liquids demand has bounced back strongly, reaching a record annual average of 101.7 million b/d last year. Growth is set to continue at a fair lick into this year and next, driven mainly by Asian demand. We expect a gain of 1.6 million b/d in 2024 and another of 1.7 million b/d in 2025.

Importantly for OPEC+, we expect the upward trend in demand to last through this decade, though at a diminishing rate. Peak demand in our base case is in the early 2030s, at just over 108 million b/d, 5 million b/d above the expected annual average in 2024.

Second, the scope for OPEC+ to increase production will also depend on non-OPEC supply

Non-OPEC countries captured 90% of contestable demand over the last two years, mainly because of booming production growth in the US Lower 48. Non-OPEC supply growth will slow, though, between now and the end of 2025, averaging just over 1 million b/d. That’s more than 40% below the rate of the previous two years and less than demand growth.

US Lower 48 growth is slowing down as operators respond to cost inflation, with the service sector operating at near capacity. A lower rig count will lead to US L48 supply growth dropping by two-thirds in 2024 and 2025, from 0.9 million b/d last year. We don’t believe the big mergers of tight oil players in the last nine months will lead to a resurgence in production. Instead, operators will more likely stick to strict capital discipline and high-grade drilling plans for the combined inventory.

Production growth from other non-OPEC growth centres – including Canada, Brazil and Guyana – more than offset declines from mature provinces. But it doesn’t move the needle.

Third, OPEC+ will have to be patient as it seeks to recapture market share if it’s to avoid undermining price

Voluntary production cuts over the last two years totalled 5.8 million b/d across the group. The early June announcement signals the stealth by which OPEC intends to return supply to the market. The first two cuts, totalling 3.66 million b/d, will stay in place. The third tranche from November 2023 of 2.2 million b/d will be returned by increments over the four quarters from October 2024 to September 2025, subject to market conditions.

The nearly US$3/bbl drop in the Brent price immediately after the announcement hints at the delicate challenge ahead and market concerns, although the price has since recovered. With demand growing and non-OPEC supply growth moderating, our analysis suggests there is sufficient headroom for OPEC+ to put most, perhaps even all, of that tranche back into the market within the planned timeframe.

Finally, the three rounds of production cuts were enacted over just 13 months from October 2022 to November 2023. Reversing them will take much longer. On our current forecasts for global demand and supply, it will take several years to fully unwind the cuts

Source: Wood Mackenzie