As nations battle to decarbonize, geared towards meeting zero emission target, there is growing concern as to what the trajectory for global oil demand is likely to be in the coming months, and possibly years.

Latest report from Wood Mackenzie has revealed that demand for oil is due to rise by 1.5 million barrels a day (b/d) this year, with a significant portion of this growth anticipated in the latter half of the year.

This will include, according to the report, total liquids demand which also comprise refined products and separately ethane and liquefied petroleum gases (LPG), all of which come from natural gas liquids and do not pass through the refining system. The refined products demand includes gasoline (excluding biofuels), diesel/gasoil (excluding biofuels), naphtha, jet kerosene and fuel oil, while including also biofuels as a separate category for the forecast on demand.

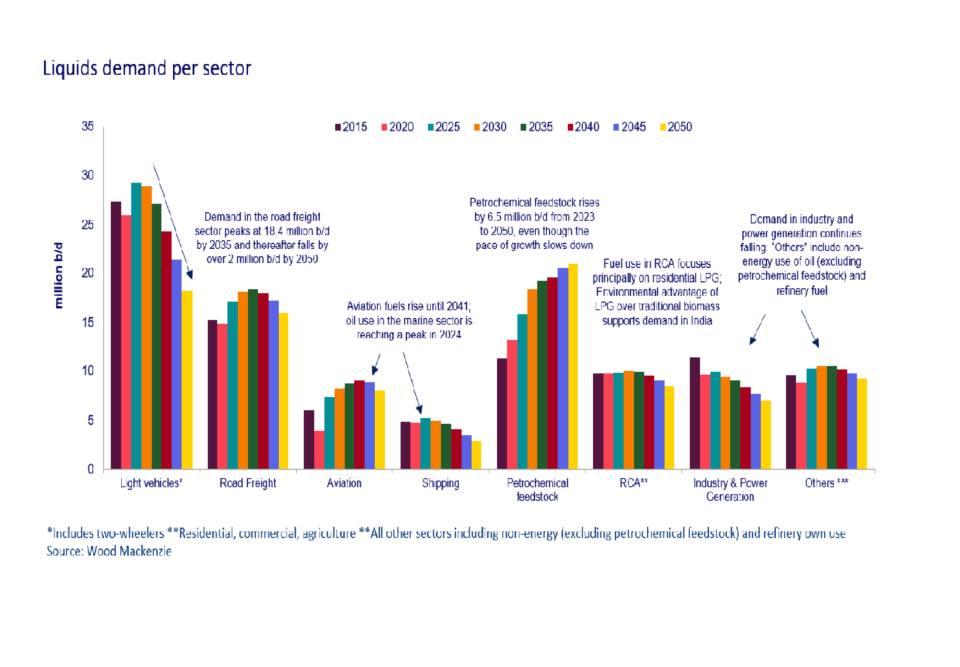

Woodmac’s long-term projection came by an assessment of sector demand which was also broken down according to refined product or liquid. The sectors will include light vehicles, road freight, aviation, shipping, petrochemical feedstock, residential, commercial and agriculture and industry and power generation. The other category will include non-energy use, such as bitumen for road construction, and refinery own-use fuel.

Two key drivers of long-term global oil demand according to the report will include economic growth and population trends. Woodmac therefore forecasts GDP growth (which serves as a critical element in the scenario) to average 2.2% annually between 2024 and 2050. This the report reveals means that the global economy will nearly double in size to US$170 trillion by 2050 (annual GDP in constant US$2015 terms). China and India will account for 43% of all global GDP growth from 2024 to 2050. Europe and North America will contribute 30% of global growth in this period.

For the demographic outlook, and using the UN Population Prospects 2022 report, Woodmac believes that the world’s population will possibly hit 9.7 billion in 2050, up from 8 billion in 2022, with Africa as the main driver of the population growth, while China and Europe slip into a declining trend for their populations. This also means, according to Woodmac’s long-term forecast, that oil demand in Africa will show growth by 2050.

These economic and demographic trends Woods say is expected to exert significant upward pressure on liquid demand, however, intensifying efforts toward decarbonisation, away from oil, and counterbalancing the upward force will ultimately lead to a plateau and then a decline in oil demand.

The timing and scale of the global peak in oil demand and the ensuing demand reduction Woods say are intrinsically linked to the trajectory of EV sales. Breaking it down to identify the light passenger vehicles, Woods say that the total share of EVs (BEVs and PHEVs) in new car sales globally is expected to climb from 18% in 2023 to 45% by 2033, with China, Europe, and the US at the vanguard. And by 2050, EVs are projected to constitute over two-thirds of global car sales and more than half of the car stock. For the US, although the EV sales share is revised down from 21% to 14% for 2025, EVs are expected to account for over 50% of new light passenger vehicles by 2033, then surpassing 80% by 2050. With global gasoline demand culminating by 2028, overall road sector demand is expected to reach a peak by 2029, followed by a long-term decline

While oil use in aviation continues to grow until the end of the 2030s, it is expected to peak by the mid-2020s for marine. Liquefied Natural Gas (LNG) is expected to have a much greater role in shipping compared to other transport sectors, while mandated fuel efficiency standards by the International Maritime Organization (IMO) also start to erode fuel demand, says Woods.

In what it has referred to as “hard-to-abate sectors”, electrification is considerably more challenging compared to the road sector. The report adds that electric vehicles are expected to have a much smaller role, due to the much higher power-to-weight ratio typical for planes and ships. Nevertheless, electrification Woods say is expected to develop to some extent in the short-haul aviation and short-sea shipping markets, where distances are much lower.

In terms of identifying key routes to decarbonisation, sustainable aviation fuel (SAF) will play a key role in lowering the carbon footprint of aviation. The report adds that as demand for biofuels declines in the road sector due to increasing electrification, it is expected that the aviation sector will exert the greatest pull on biofuel volumes, paying a higher premium compared to other transport sectors. As for shipping, there’s the expectation that the pull for biofuels would be weaker compared to aviation, and renewable fuels of a non-biological origin (RFNBOs) to be an important means of decarbonising shipping. The fuels will include the likes of e-ammonia, and e-methanol, which are expected to appear as alternative shipping fuels within the next decade.

Petrochemicals are regarded as the building blocks of modern society. Made from it are items like clothing, tyres, digital devices, packaging, detergents, healthcare, with countless other everyday materials that enable modern life. So with growing global populations and rising income levels, Woods believe that demand for petrochemicals will rise, for petrochemical demand per capita tends to have an S-curve linkage with GDP per capita, Woodmac opined., and this is as Europe and North America sit on top of the S-curve with demand growth intricately linked to GDP growth.

For emerging economies, rising incomes deliver rapid petrochemical demand growth once the income thresholds on household appliance and vehicle ownership are breached. Woods believe that this convergence of petrochemical usage will deliver demand growth at rates higher than global GDP growth for the medium term. Adding however that as usage converges, demand growth will impact the GDP levels, which will further impact on policies and regulations, while recycling will reduce growth further over the long term. By 2050, petrochemical feedstock demand is projected to be almost 50% larger than 2023 levels.