- Some regions in US to see 15% electricity demand growth through 2029; prices could escalate

It looks like a clarion call as Wood Mackenzie’s latest report discloses an impending power shift in the US power demand scenario it said has remained essentially flat for the past decade but which is about to change as a surge in demand growth now comes as the biggest challenge before the utility companies in decades.

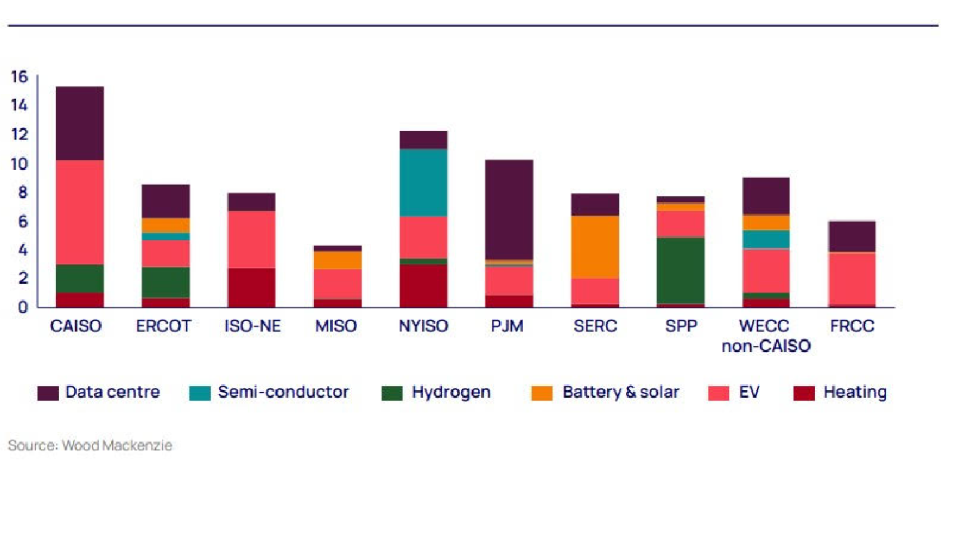

According to the report, “Gridlock: the demand dilemma facing the US power industry,” US electricity demand growth will be between 4% and 15% through 2029, depending on the region, with burgeoning data-centre development, a resurgence in energy-intensive US manufacturing, and greater transport and heating electrification driving electricity demand growth not seen since the 1990s. Demand growth rates for individual utilities may be much higher as the demand being added to the grid is not evenly spread, and one large load can have a significant impact on the growth of individual utilities, according to the report.

All of this the report added, would be capable of proving a major challenge for utilities to adapt and provide interconnection and new supply, as well as companies with large electricity needs to sustain growth.

“In most industries, demand growth of 2-3% per year would be easily managed and welcomed,” says Chris Seiple, Vice Chairman of power and renewables with Woodmac. “In the power sector, however, new infrastructure planning takes 5 to 10 years, and the industry is only now starting to plan for growth.

“Moreover, most state public utility commissioners have little experience of regulating in a growth environment. And as technology C-suites realise that energy may be the largest constraint on their growth, they are shocked as businesses that move at light speed learn about the pace at which electric utilities move.”

While the report identifies data centers and the burgeoning artificial intelligence industry as main drivers of activity, Woodmac said 51 GW of new data-centre capacity announcements have been recognized since January 2023. In the Horizons report, Woods says it has considered a scenario in which electricity demand from data centres grows by a mid-range estimate of 15% per year over the next five years, which is about 25 GW of new data centre capacity.

Adding that data centers will be competing with a resurgence in US manufacturing, particularly in the areas of battery, solar wafers and cells and semiconductors, which are projected to add up to15, 000 MW of high-load-factor demand over the next few years.

The report also identifies the wider electrification of the economy as capable of driving demand, this is with electric vehicle use continuing to grow and electrolysers connecting to the grid potentially thereby adding another 7,000 MW of demand through 2030.

On capacity constraints, report discloses that many cogs will, and are already impacting the system’s ability to meet this demand growth, such as coal plant retirements, the lack of transformers and breakers needed to interconnect new plants and large loads, and the slow pace at which interconnection studies are completed and transmission capacity is added to the grid. Thus forecasting annual utility scale renewable additions to grow from around 29 GW to 40 GW per year from now until 2030.

“The constraint is not the demand for renewables, but the ability to get through permitting, interconnection and building out the transmission system accordingly,” said Seiple. “All things being equal, our renewable forecast additions would accommodate electricity demand growth of about 2% per year. If renewables are only able to barely match the pace of demand growth, it means we won’t be decarbonizing the power sector.”

Little demand growth the last 15 years in the US and some new supply from renewables according to the report, has kept wholesale power prices lower, “but this may change.”

“With new demand growth comes a new era,” said Seiple. “Electricity prices will be under upward pressure. Valuations of fossil and nuclear assets are increasing as the market absorbs this new paradigm. More announcements of deferred coal plant retirements and efforts to reopen previously closed nuclear plants may follow. What will be most interesting is how this plays out in markets where there is no retail choice versus markets where it does exist.”

The report concludes that transmission planning, permitting and construction are the biggest bottlenecks to meeting future demand growth. It will take an integrated approach from utilities, regulators and policymakers to meet this challenge and buildout needed to protect US national security, boost strategic economic growth and decarbonise the power sector to address climate change.

“This will be a major challenge. The last time the US electricity industry saw unexpected new demand growth like this was during World War II,” said Seiple. “Between 1939 and 1944, manufacturing output tripled, and electricity demand rose 60%. It was a closely coordinated national effort that brought together industry and policymakers to address the challenge and find innovation along the way. A similar effort is needed now.”