The United States natural gas production from both shale and tight formations, said to be accounting for 79% of dry natural gas production, decreased but slightly in the first nine months of 2024 compared with the same period in 2023, Oilprice.com reported. Adding that should the trend continue the remainder of 2024, it would mark the first annual decrease in U.S. shale gas production since the collation of data which Oilprice reported to have started in 2000.

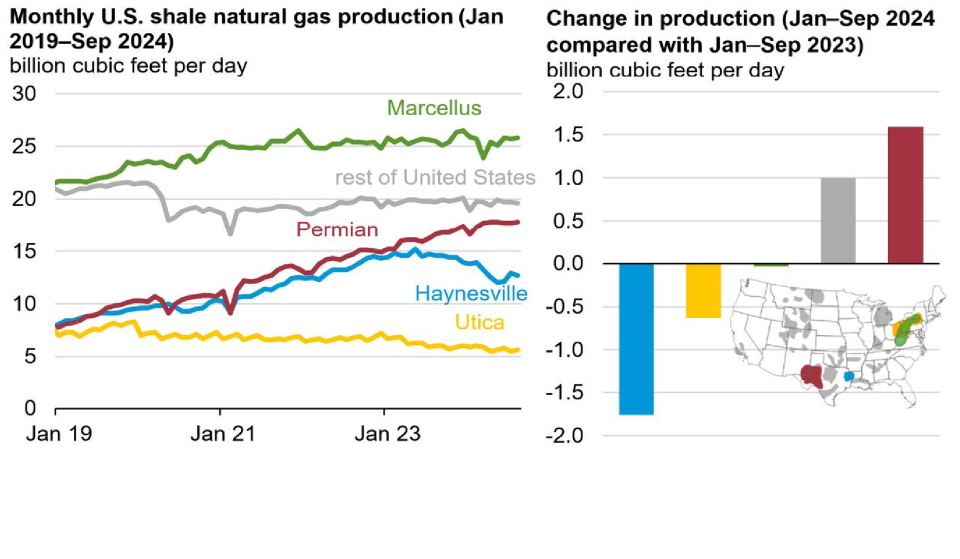

According to the report, total U.S. shale gas production from January through September 2024 declined by about 1%, to 81.2 billion cubic feet per day (Bcf/d), compared with the same period in 2023, while other U.S. dry natural gas production increased by about 6% to 22.1 Bcf/d. Total U.S. dry natural gas production from January through September 2024 averaged 103.3 Bcf/d, essentially flat compared with the same period in 2023.

Attributing the cause of the decline in production to declines in production in the Haynesville and Utica pays, the report went ahead to disclose that from January through September this year, shale gas production decreased by 12% (1.8 Bcf/d) in the Haynesville and by 10% (0.6 Bcf/d) in the Utica compared with the same period in 2023. Simultaneously it says, shale gas production in the Permian play grew by 10% (1.6 Bcf/d). Production in the Marcellus play, which leads U.S. shale gas production, remained flat.

Disclosing that the Haynesville play in northeastern Texas and northwestern Louisiana is a dry natural gas formation. Meanwhile the Utica and Marcellus plays in the Appalachian Basin only produce lease condensate in addition to dry natural gas. Adding that in all the three plays, natural gas prices mostly drive drilling and developing wells. It further added that the U.S. benchmark Henry Hub daily natural gas price has equally and generally declined since August 2022 reaching record lows in the first half of the year, making drilling natural gas wells less profitable, particularly in the Haynesville. It says that several operators in the Haynesville and the Appalachian Basin shut in natural gas production in reaction to the historically low prices, and this is with the intention to continue the curtailments in the remaining months in 2024.

Contrastingly it says natural gas produced in the Permian play in western Texas and southeastern New Mexico is primarily associated gas from oil wells where drilling and development is driven by the oil price. Natural gas production in the Permian therefore, the report added, has increased this year, along with the increasing oil production.

It reports that production in the Utica was 5.6 Bcf/d in September, 33% less than the monthly high of 8.3 Bcf/d in December 2019 and 10% less than the average of 6.2 Bcf/d in 2023. At depths of 5,000 feet to 11,000 feet, wells in the Utica, which lies beneath the Marcellus, are slightly more expensive to drill than Marcellus wells because of their depth.

Drilling costs of Haynesville wells, at depths of 10,500 feet to 13,500 feet, are even higher. Shale natural gas production in the Haynesville was 13.0 Bcf/d in September 2024, 14% less than the peak in May 2023. The Haynesville is the third-largest shale gas-producing play in the United States, behind the Marcellus and the Permian plays. In 2023, shale natural gas production in the Haynesville averaged 14.6 Bcf/d, accounting for 14% of total U.S. dry natural gas production.

The U.S. benchmark Henry Hub natural gas price fell 79% from the August 2022 inflation-adjusted high of $9.39 per million British thermal units (MMBtu) to an average of $1.99/MMBtu in August 2024. So far this year, the price has averaged $2.10/MMBtu compared with an inflation-adjusted average of $6.89/MMBtu in 2022 and $2.62/MMBtu in 2023. As natural gas prices declined, the economics of producing natural gas in the dry gas formations worsened, leading producers to shut in production and drop drilling rigs.

Producers tend to increase or decrease the number of drilling rigs in operation as natural gas prices fluctuate. The number of natural gas-directed drilling rigs in the Haynesville, Utica, and Marcellus plays has decreased steadily since the end of 2022, according to data from Baker Hughes. In the Haynesville, an average of 33 rigs were in operation in September 2024, 53% fewer than in January 2023. The number of rigs operating in the Haynesville in September was the lowest it has been since July 2020.

In the Utica, an average of seven rigs were operating in September 2024, fewer than half the number that were operating in January 2023, and in the Marcellus, an average of 25 rigs were in operation, about 36% fewer than in January 2023. Although the productivity of newer wells has improved in recent years, the decline in rig counts has contributed to an overall decrease in production.

Total U.S. dry natural gas production is forecasted to average 103.5 Bcf/d in 2024, down slightly from 103.8 Bcf/d in 2023, and to resume modest growth in 2025 at 104.6 Bcf/d.

Source: Oilprice.com