A technical workshop held at African Energy Week: Invest in African Energies 2024 hosted experts from Rystad Energy, Africa Finance Corporation and Afentra to discuss Africa’s oil and gas growth potential

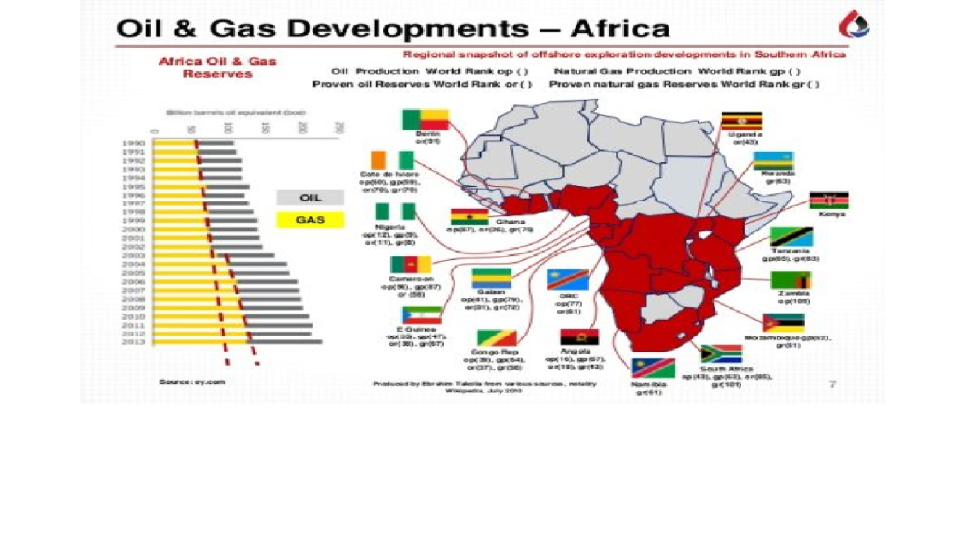

Africa will host the majority of new oil and gas discoveries over the next 30 years compared to other regions, according to Per Magnus Nysveen, Senior Partner and Head of Analysis at energy intelligence firm, Rystad Energy.

In a panel discussion held at the Pre-Event Workshop Day during the African Energy Week (AEW): Invest in African Energies 2024, Nysveen said that to supply the growing global energy demand, Africa needs to introduce more licensing rounds to exploit its huge untapped potential.

In the past three to five years, says Nysveen, the continent has introduced 300 million barrels of oil every year and replaced 10% of existing production with new projects.

Nysveen said: “We underestimate the resources Africa has. Risk is overestimated by global investors and there are little licensing activities. Africa needs to capitalize on the massive capital being brought in by the small E&P firms, as well as by the majors to unlock its full potential.”

Ibitola Ukabam, Associate Vice-President, Natural Resources (Oil & Gas and Mining) at investment firm Africa Finance Corporation also added that 85% of growth within the oil and gas sector will emerge outside developed economies, with Africa holding a large share.

Adding further Ian Cloke, COO at upstream oil and gas firm Afentra, stated that unlike in the North Sea where investment has increasingly become unfeasible in the past 15 years due to transition policies, Africa was prioritizing a just energy transition, hence new investments coming in.

Expanding on the origin of the majority of growth in Africa, Cloke still added that “Angola has the most stable fiscal terms. The creation of enabling environments onshore in Nigeria, Libya and South Sudan can fast-track project rollouts.”

Pranav Joshi, Vice President of Rystad Energy, added that “TotalEnergies’ FID on the Venus prospect in Namibia, as well as Mozambique’s Area 4 project would drive new FIDs and production growth in Africa in the next few years.”

With deepwater projects and supply proving secure globally, Ukabam reiterates that the need for global majors to invest in local infrastructure was imperative, adding that this has the tendency of enhancing Africa’s potential to source offshore resources to meet local demand. Adding that majors must not continue making slow decisions to develop local infrastructure, to match their export agenda.