By Victor Uchechukwu

- Find could add more than 50 mmboe net proved reserves; preliminary prospect valuation suggests peak production could reach 65,000 barrels per day

Miles Sasser, senior research analyst, upstream for Woods has this to say: “For Talos, the discovery is a game-changer. The company’s GoA portfolio was ageing, but Daenerys could add more than 50 millions of barrels of oil equivalent (mmboe) net proved reserves. That would increase its YE2024 proved reserves of 194 mmboe more than 25 per cent.

“This is the company’s largest discovery to date in the GoA. While Talos has not released volumes, a 200 mmboe discovery would make Daenerys GoA’s biggest find since Shell’s Whale in 2017.”

Energy Window International (Media) gathered that the discovery well was drilled to a total vertical depth of 33,228 feet, finishing 12 days early and US$16 million under budget, “demonstrating strong operational execution by the Talos-led consortium.”

Woods said that its preliminary prospect valuation apparently suggested peak production could reach 65,000 barrels per day. This was as the company noted that the discovery has marked a strategic shift for Talos whose traditional focus was on lower-risk infrastructure-led exploration (ILX) projects. Again, beyond Daenerys, the company said it has also two additional large exploration projects in its pipeline – Enterprise and Hershey – both with pre-drill estimates exceeding 100 mmboe each, “signaling Talos’s embrace of a more aggressive high-impact exploration strategy.”

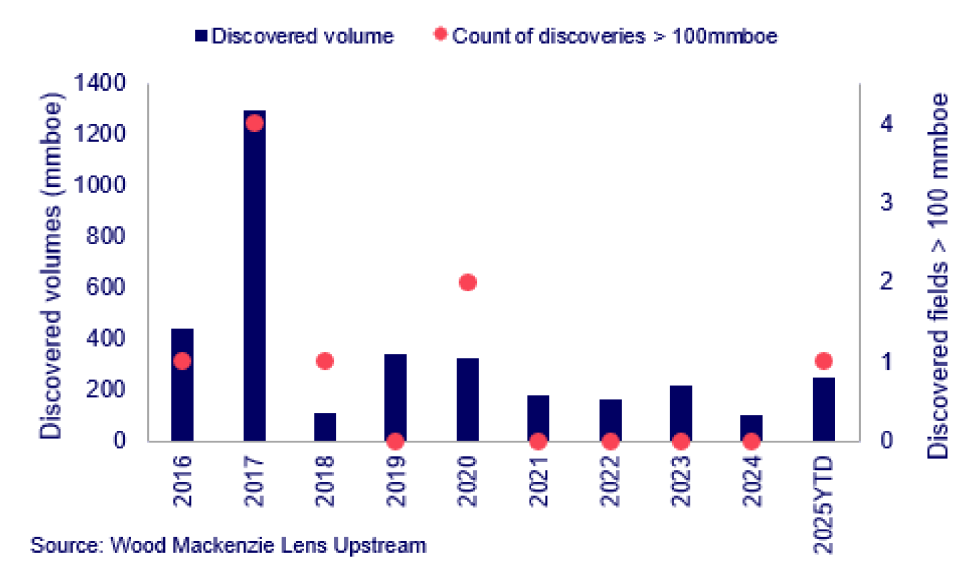

Combined with bp’s Far South discovery in April 2025, Wood’s Sasser said it was the best year for exploration success on a volumes discovered basis since 2020. With multiple exploration wells still planned for the year, 2025 has the potential to move even further up the list, Sasser said.

“The timing is particularly significant with December’s lease sale approaching,” says Adrian Tjokro. “The discovery proves there are still major prizes to be found in the sub-salt Miocene, potentially intensifying competition in the Walker Ridge area as companies look to capitalize on favorable royalty terms.”

“Shell’s minority non-op stake is telling. The backing signaled real confidence in Daenerys as the supermajor operates 95% of its GoA net production,” Woods disclosed as one key element.

Another key find was its tieback or new hub potential: A 24-mile tieback to the Oxy-operated Heidelberg field is feasible says Woods, given the facility’s ample spare capacity. However, the remote location could warrant a new hub, which Woods had already estimated the total project PV10 of US$745 million, “with an IRR of 18% at US$65 Brent, and a payback period of six and a half years from project sanction.”

The One Big Beautiful Bill Act could open more such finds. Woodmac believes that a provision of the act will allow for production of multiple stacked reservoirs through a single wellbore. Thus, Daenerys could be the first stand-alone Miocene project planned with this rule in place – offering Talos flexibility on well design and development plans.

“The Daenerys discovery could reshape the exploration strategy for Gulf of America’s Walker Ridge area,” says Tjokro. “While the Big Foot discovery marked the first subsalt Miocene find in the Walker Ridge margin, Daenerys confirms that the Subsalt Miocene trend extends westward into the region and into an area that previously only held Paleogene-aged fields. This success could trigger a re-evaluation of the area for other overlooked sub-salt Miocene potential after a multi-year absence of 100+ mmboe discoveries in the region.”