By Ejekwu Chidiebere

Global upstream activity according to Rystad Energy is expected to keep the momentum in 2026, with what it has called, “high-impact wildcat drilling engagement”, following a sustained 2025 activity. Rystad records that high-impact wildcat wells last year rose to 38% from 23% in 2024, while total discovered volumes increased by 53% year on year to around 2.3 billion barrels of oil equivalent (boe).

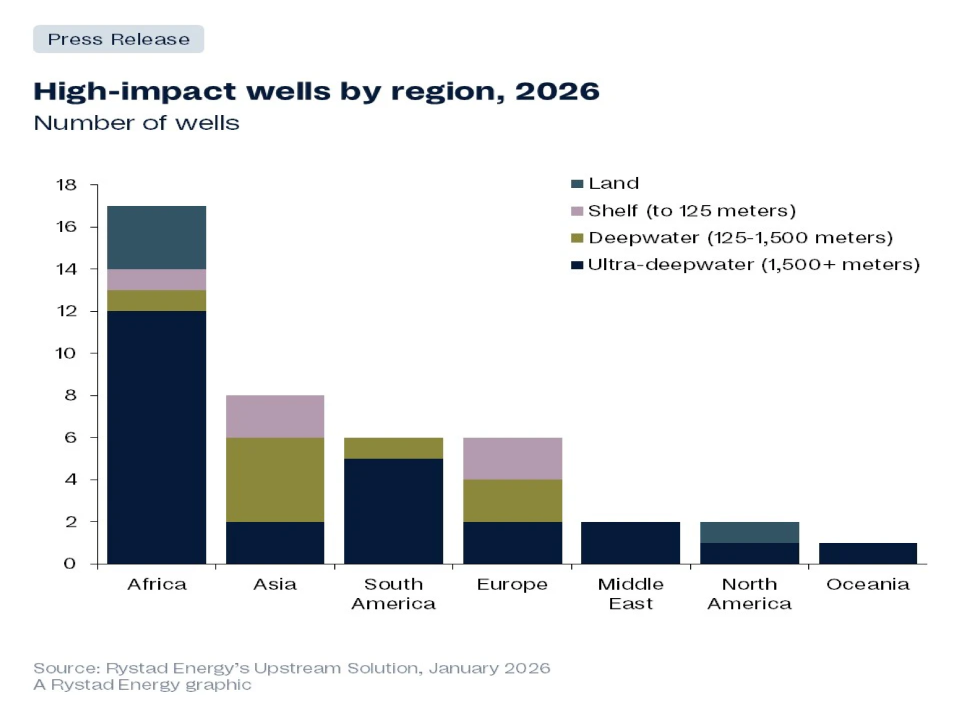

While explaining that wells are designated as high-impact based on a variety of factors including the size of the potential resources, whether they could open new hydrocarbon plays in frontier or emerging basins, and their significance to the operator, Rystad posits that in 2026, such activity is also likely to drive exploration momentum even higher in specific basins and countries. It has also identified 42 such wells globally, expressing confidence that Africa will still lead the chart in global exploration activity, accounting for around 40% of planned high-impact exploration wells, to be driven largely along the Atlantic margin. It expects that exploration to be focused on the Orange Basin in Southern Africa and the Gulf of Guinea in West Africa, which also reinforces the region’s role in global high-impact drilling.

On its high-impact well outlook for 2026, Rystad Energy says it is expecting concentration in ultra-deepwater and frontier exploration. Ultra-deepwater wells it said would account for around 60% of planned drilling, with majors leading these activities, followed by NOCs and INOCs, which together according to it represent 26%. It adds that most wells are expected to target frontier regions, while roughly 5% will focus on basins with prior discoveries that could develop into hydrocarbon hotspots, and another 5% will test entirely new plays. “Thus Africa should be playing a central role, with all onshore high-impact drilling in 2026 expected to take place on the continent except for the recently announced Greenland well, which will test the frontier Jameson Land”, Rystad analysts said.

“What we are seeing in 2026 is a clear shift in where operators are willing to deploy capital.” It further adds that even ultra-deepwater and frontier plays will remain capital-intensive, offering however scale and material upside at a time when conventional opportunities are increasingly limited. “Africa stands out because it still combines geological potential with the prospect of large, commercially meaningful discoveries, particularly for operators looking to secure long-life resources in a tightening global supply environment.”

Asia Rystad says, accounts for eight high-impact wells, led by Indonesia with four, followed by India and Malaysia with two each. It added that between 2021 and 2025, India, Malaysia and Indonesia awarded most of the region’s new acreage, each exceeding 200,000 sq km, driven largely by offshore blocks. By contrast, Kazakhstan, Pakistan and China’s dominance in onshore awards Rystad says, equally reflects Asia’s “fragmented exploration landscape”, resulting from strategic variations between offshore and onshore plays rather than adopting “a one-size-fits-all approach.” It equally identified operators such as ONGC, Petronas, Oil India, Mari Petroleum and Petro Matad who have earlier secured the largest acreage positions over this period, positioning them for lead in high-impact exploration activity in the coming years.

The report has also shown that over the past decade, Asia has recorded approximately 18 billion boe of conventional hydrocarbon discoveries, with gas accounting for around 62% of total volumes. “Discovery volumes have been highly concentrated, with the majority of additions since 2016 coming from a handful of countries – China, Malaysia, Indonesia and Vietnam.” “While Asia remains a key region for hydrocarbon exploration, opportunities are increasingly clustered in established areas, suggesting that new high-impact growth will likely depend on unlocking less mature basins or more technically challenging fields.”

“As of now, 2025 stands as the weakest year of the past decade in terms of new volume additions, with total discoveries hovering around 1 billion boe. Oil has dominated volumes added during the year, primarily due to Malaysia’s Megah and Vietnam’s Hai Su Vang discoveries.” It added that offshore discoveries accounted for roughly 83% of volumes added in 2025, with the bulk coming from the region’s main producing countries. It adds that even some upward revision to 2025 totals is expected as additional information becomes available.

In the West, it said North America’s exploration performance has weakened in the last three to four years, resulting from drops in yearly discovered volumes which have failed to even reach the previous decade-low of 750 million boe seen in 2018. In Canada and Mexico, discoveries have largely stalled Rystad said, leaving the US Gulf of America as the main source of new volumes, where recent finds remain oil-weighted and concentrated in mature, heavily explored basins. Noting that total discoveries in 2025 fell to around 238 million barrels, with Mexico contributing three finds of approximately 68 million barrels and the US Gulf of America adding four finds totaling about 170 million barrels.

“Overall, this continued reliance on mature basins, alongside declining discovery volumes, points to limited upside for conventional exploration in North America. Without access to new plays or a material improvement in exploration success, the region is likely to remain defined by incremental, oil-weighted additions rather than game-changing discoveries”, Rystad team said.