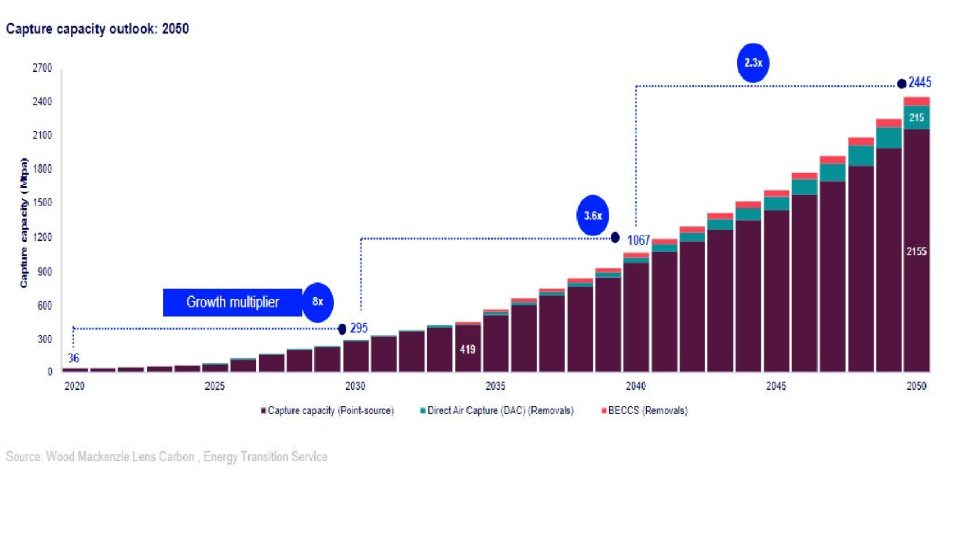

- It forecasts 2,450Mpta of capture capacity by 2050, but 780Mpta of announced projects are at risk

- Implementation of appropriate CCUS regulation and support is key in unlocking further capacity

Speaking at Wood Mackenzie’s Carbon Capture, Utilization and Storage Conference in Houston, Peter Findlay, research director and head of CCUS economics for Woodmac said that despite a growing market for carbon capture, utilization and storage (CCUS), economics has posed the greater challenge, this is with concerns that many potential projects are still under serious threats.

Findlay who says he believes that the economics for CCUS are sometimes feasible but more often fickle said: “We are tracking 1,200 announced projects globally, but only 10% of those are now operational. More than 60% of those are in the early stage of development and they would need a lot more investment and market certainty to move into advanced development.”

With the growing market challenges, Woodmac analysts still posit certain degree of potentials for considerable and favourable market growth, with its base case scenario which projects a 2.6 C global warming increase, with yet 2,450Mpta of capture capacity envisaged by 2050.

“Most of the announced projects today are at risk,” says Findlay. “Implementation of appropriate CCUS regulation and support will be key in unlocking further capacity. Current incentives are insufficient to spur widespread deployment and developers need alternative revenue pathways, like credit generation and product premiums, to supplement current government support.

Findlay notes that there are potential pathways for utilization products that could bring opportunities to the market, particularly in e-hydrocarbons, minerals and agriculture, and next-gen materials, such as fuel cells.

Says Findlay: “Another case for optimism is the current funding and interest in the market.” “The US Department of Energy recently announced more than $2B in CCUS funding and a lot of major players are getting into the market. As competition increases, costs should come down. We estimate costs will fall 50% by 2050 in real terms.”

But market certainty, says Findlay, is elusive for current projects, even as many may never get off the ground in this environment, he said.

“Many of these projects will take decades from inception to completion and the current incentive system does not support these timelines,” he said. “If a policy may not be in place in 10 years, developers don’t have the certainty they need to move forward and invest.”