Carbon capture, utilisation and storage CCIS has reached a crossroads. Heralded by some as an essential technology to slash carbon emissions, the number of proposed projects has soared. But talk is cheap: the focus must now switch to committing to final investment decisions (FIDs) and project execution to start building scale.

What is driving the rising optimism around CCUS? Is the capital available to deliver at scale? And which companies are leading the pack?

Gavin Thompson, Vice Chair EMEA, spoke to Lucy King, Principal Analyst, CCUS, to understand why 2025 could be the sector’s breakthrough year.

Why the excitement now?

Conditions supporting CCUS development have emerged over the past few years. CCUS has long been viewed as a key tool to get the world on a 2 °C or lower pathway. It’s now even more important with energy security and the cost-of-living crisis set to leave the world dependent on fossil fuels for decades to come.

Operational capacity looks to rise from 94 Mtpa to 120 Mtpa in 2025, the largest annual increase to date. Smooth project executions will also be crucial milestones in understanding future project costs, operations and challenges. The successful delivery of large-scale start-ups in 2025 should also pave the way for future growth.

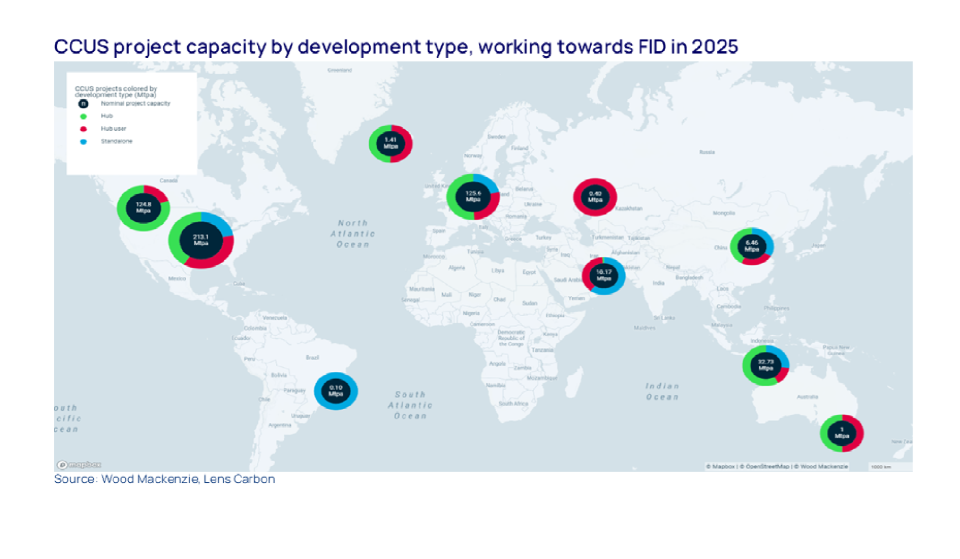

FIDs are also expected to break records. In total, we estimate around 200 projects are working towards FID this year, equal to 500 Mtpa of the 2 Btpa of total planned capacity. On a risked basis, some 285 Mtpa of this is likely to go ahead, representing the largest amount of capacity approved in a single year.

Where is the capital coming from?

That’s the big question. CCUS projects are near-universally a cost rather than a revenue stream. And capital intensity is the obvious obstacle across the value chain, especially so where policy and government support are insufficient or lacking.

Governments have a key role to play. We expect more countries to boost incentives, including subsidies, tax credits and contracts for difference schemes for CCUS investments this year. Sweden and Denmark have committed significant financial support for new CCUS bidding rounds, while Japan is expected to allocate funding to JOGMEC’s selection of nine “Advanced CCS Projects”.

But money can’t be taken for granted. Government budgets are tightening worldwide, constrained by stubbornly high levels of inflation and interest rates, and, in the US, proposed sweeping tax cuts.

There, CCUS’s important role in blue hydrogen projects will continue to be driven by bipartisan support for the 45Q tax credit and the oil and gas sector’s appetite to invest. But more broadly, the incoming administration’s stance on CCUS remains unclear, especially regarding storage permitting and new rounds of funding. Elsewhere, the UK government’s support for future projects outside its cluster sequencing process looks uncertain in both extent and timing due to economic headwinds. In Canada, the upcoming federal election could result in instrumental changes to its federal carbon tax.

Which companies are leading the way?

With increasing pressure on companies to decarbonise, CCUS is rapidly being integrated into corporate energy transition strategies. A growing number of companies – including ADNOC, Chevron, ENI, Equinor, Inpex, OMV, QatarEnergy and TotalEnergies – have announced corporate CCUS targets. These targets are typically around 10 to 25 Mtpa by 2030, many tied to companies’ own storage ambitions. Some companies are on track to meet targets, others look challenged. With the clock ticking, dealmaking looks the primary route to ensuring targets are met.

The 2023 acquisition of Denbury for US$4.9 billion has propelled ExxonMobil into CCUS sector leadership – we expect further deal activity across the industry this year. Portfolio rationalisation is climbing the agenda as project costs and economics come into focus.Most CCUS projects remain marginal. Companies are likely to look to reduce risk and financial liability by either farming-out interests or completely divesting assets that don’t make the grade.

With over 600 companies involved in at least one CCUS project in the planning or operational development stages, strategic partnerships should proliferate, bolstering experience, skillsets and access to capital. Last year’s merger between SLB and Aker Carbon Capture to form SLB Capturi has opened the door.

Can countries without adequate CO2 storage embrace CCUS?

For countries lacking suitable sub-surface storage capacity, exporting captured CO2 for permanent storage offers a solution. The first commercial-scale, cross-border transport is set to begin later this year when CO2 from an ammonia plant in the Netherlands is shipped to Norway.

International regulations for shipping and storage of CO 2 are still evolving, with the cross-border transport of CO 2 still prohibited under the London Protocol. Governments are actively seeking policy amendments and bilateral agreements with importing countries to resolve this. Following the first wave of agreements signed in Europe, we expect Japan and South Korea to lead the charge in Asia this year with export deals for storage with Malaysia, Indonesia and Australia. In addition to supporting their decarbonisation efforts, these deals would also help lock-in future imports of coal and LNG for two of Asia’s economic giants from their existing suppliers.

Simon Flowers