- Could have adopted a strategy for effectively delivering a low emission and more sustainable future but it hit below the belt,

- Strategy needs revolutionizing to be able to provide the solid business foundation to thrive

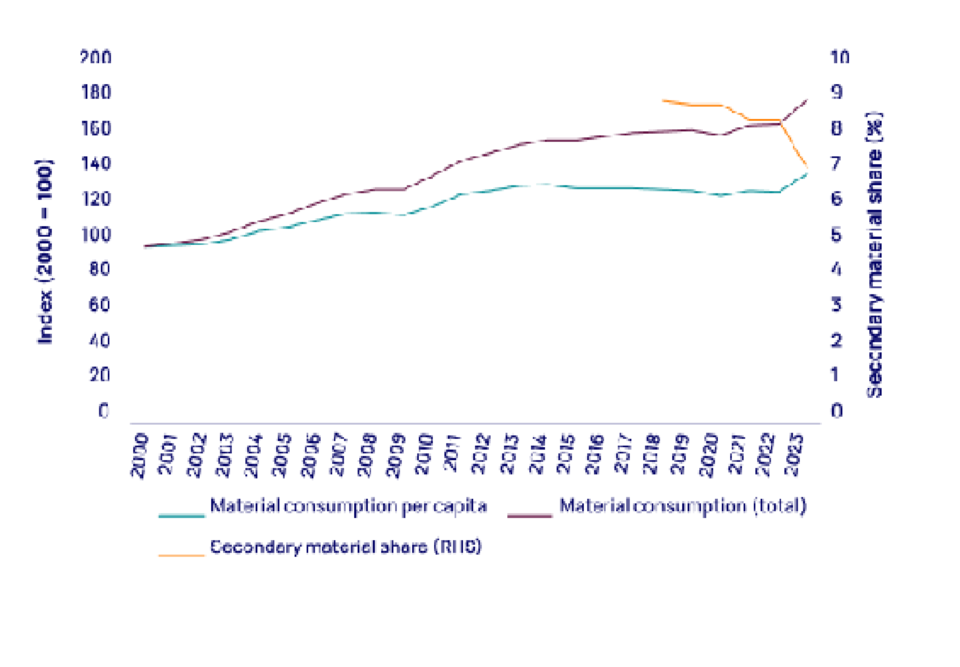

A circular economy, a critical strategy for delivering a lower-emission, more sustainable future by reusing materials and minimizing waste has made disappointingly little impact on key energy transition manufacturing industries including plastics, electronics and biofuels over the last decade as it struggled to navigate traditional value chains and business practices, Woodmac’s latest industry report has shown.

Referred to as “Waste to Wealth: Unlocking Circular Value Chains”, in its “July Horizons” report, states that despite the rising tide of corporate commitments and regulatory targets, progress of the circular economy model has been extremely slow. Adding that while there are profits to be made in circular value chains, the fundamental problem has been finding the best way of ensuring these profits are shared fairly across complicated, fragmented value chains.

“The circular economy model has not made the impact many plastics industry observers predicted when it was first mooted, but there are some exciting initiatives underway that could change that”, Guy Bailey, Vice President of Oils & Chemicals Research at Woods was quoted as saying. “The successful negotiation and introduction of the United Nations Plastic Treaty [a legally binding agreement that would end plastic pollution]” he says, “is a necessary starting point, but the adoption of new business models to drive coordination across the value chain is the key to real change.”

The report further stated that currently petrochemical companies, technology companies and waste management firms are all operating with different assumptions about what a ‘fair’ allocation of value was supposed to look like. Noting that in the absence of a very clear route to profitability for all value chain participants, the result is inevitably slower-than-anticipated technological adoption, not excluding investment in the necessary waste infrastructure anyway. The report adds that with so much added complexity in circular economy value chains, commodity-producing firms – such as the petrochemicals sector – must step up to the mark and help drive the necessary coordination and collaboration through the adoption of novel business relationships.

The report highlighted part of the frameworks to include partnerships which are suitable for less complex projects while offering companies with the chance to retain autonomy; joint ventures which are more suited to strategic projects needing specialist market knowledge with absolutely vertical integration which involves acquiring suppliers and distributors to maintain complete control of a project.

In peroration, the report underlined a number of recommendations which will ensure that the circular economy model overcomes its initial teething troubles and lives up to the hype that has built up around it as a genuine economic system that actually works.

They include, changing strategic thinking to accommodate how to bring about the value chain transformation needed for success; encourage investors to acknowledge the long-term benefits of first mover status in circularity to exceed short-term dilution of profits while ensuring stronger relationships are built with brands that will support the creation of the complex value chains required for growth.

“The journey to full circularity has not got off to an ideal start,” Bailey concludes. “But with clear and consistent regulation and creative collaboration then the circular economy model can still provide an effective solution to reducing waste and lowering carbon emissions.”