Captured CO2 for enhanced oil recovery (CCS-EOR) has fallen out of favour in recent years and has been supplanted by captured CO2 to dedicated sequestration (CCS-Storage), however, a new analysis shows that CCS-EOR will often deliver lower emissions and better support the energy transition, according to Woodmac’s reports series.

“CCS-EOR has its detractors, most of whom centre their opposition to the practice around the notion that CCS-EOR continues incremental global hydrocarbon production, exacerbating climate change and keeping the world reliant on fossil fuels”, says Peter Findlay, Director, CCUS economics for Wood Mackenzie. “However, as new oil supply must be developed in decades to come in even the most aggressive decarbonisation scenarios, CCS-EOR is not necessarily more likely than any other competing supply sources – whether from producing, discovered, or to-be discovered fields – to increase global oil demand.”

Woods reports that the world will need 30 million barrels per day of global oil supply by 2050 in its most aggressive Net Zero by 2050 scenario. In its three-part “Enhanced oil recovery with captured CO2“ report series, Wood’s analysis discovered that CCS-EOR would displace nearly all volumes it produces from the global market, without to bother about any material effect on global oil demand and concomitant emissions.

“Yet, although we believe CCS-EOR can deliver lower net emissions in many global plays due to its relatively low incremental emissions and lighter oil production, we acknowledge that there are some cases where CCS-Storage will deliver a lower net impact to global emissions”, says Findlay. “It all depends on the project, the geology, and the oil and carbon markets.”

According to the reports, subsidizing CCS-EOR on a per-ton basis at commercial scale less than CCS-Storage Storage, and even CCU (Carbon Capture and Utilization), will ultimately result in less CO2 captured globally and less overall decarbonisation for the economic burden imposed.

“Our findings show that subsidizing CCS-EOR less than CCS-Storage, and even CCU, will ultimately result in substantially less global carbon captured and less overall decarbonisation for the given economic burden placed on the economy — on taxpayers, consumers and businesses”, Findlay also said. “Lower subsidization for EOR exists currently in Canada and the US. What is worse, is that by subsidizing CCS-EOR less than CCS-Storage, governments are effectively, if indirectly, subsidizing other sources of oil supply, many of which are higher emitting and outside of their jurisdiction. This can weaken a country’s energy security and diminish geostrategic advantages drawn from domestic production.”

As firms look to maximize shareholder returns, decarbonize portfolios, and maintain supply amid geopolitical tensions (for OECD producers and national oil companies alike), talking about viable strategy for producers, leveraging CCS-EOR could offer a pragmatic solution for the energy transition that could yield a lower carbon footprint than traditional oil and gas operations, said Findlay.

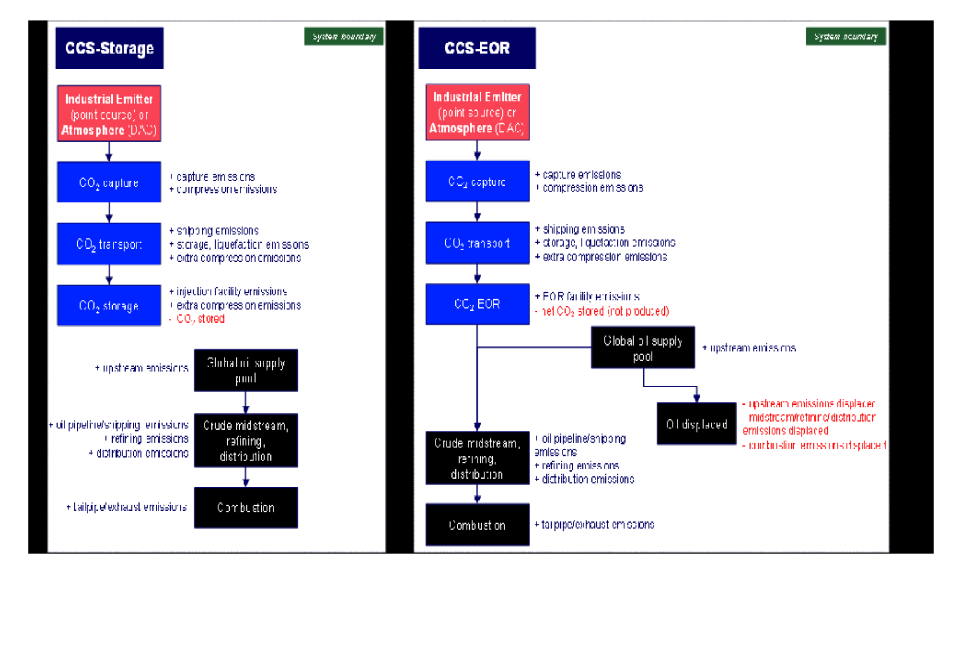

Woodmac’s account went on to that CCS-EOR can equally become an energy transition solution but only when the CO2 used in EOR operations is derived from anthropogenic sources extracted from industrial point sources or directly from the air, known as Direct Air Capture (DAC).CCS-EOR, which also allows producers to vary production between EOR and non-EOR (storage) wells depending however on prevailing oil and carbon markets conditions (and subsidies).

“Some CCS-EOR operators like Denbury and Occidental Petroleum have looked at pushing the capture benefit into the product value chain to create a net zero oil”, Findlay said. Adding he said: “Maximizing injection of this CO2 into depleted oil and gas reservoirs and storing more CO2 than the lifecycle emissions of the incremental oil and gas produced are the second and third steps to create an effective net zero oil. But the devil is in the details: the accounting and demarcation details as to what is included in the net zero oil calculation. And assuming net zero oil is credible, it is in most cases not yet economically viable for producers to pursue without increased market demand.”

Like many other decarbonisation initiatives, the reports wind down, growing CCS-EOR to a meaningful scale will for sure require some level of certainty in either future subsidization schemes or carbon price – a clear incentive to decarbonise, as an imposed carbon price would only but favour CCS-EOR production enough in order to spur its growth vis-à-vis other options in many cases.