By Stephanie Daniels

- Infrastructure bottlenecks may delay projects to 2029

- US$28 billion Hyperscaler Investment could reshape the grid systems

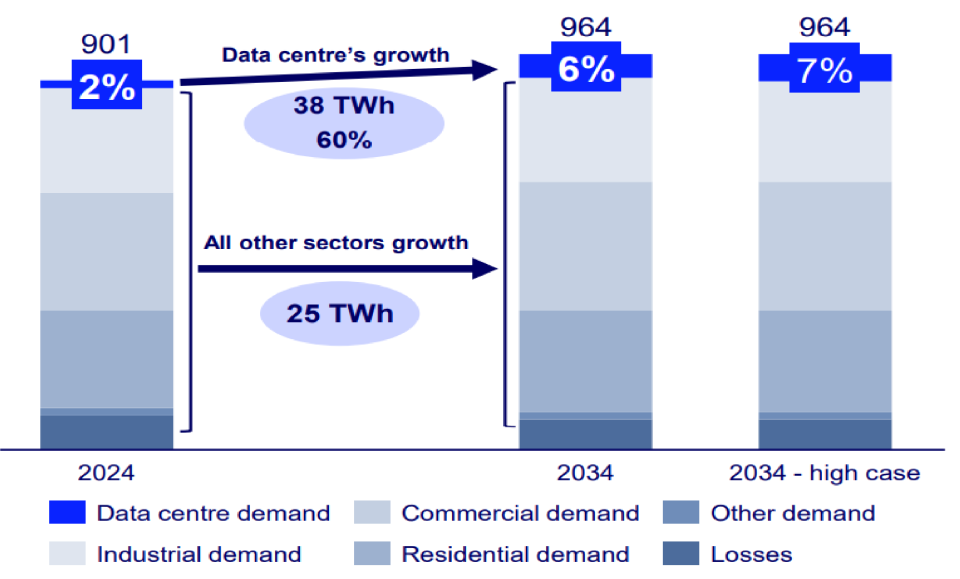

Japan’s data centres will consume as much electricity as 15 million to 18 million households by 2034, driving 60% of the country’s total power demand growth as hyperscalers invest US$28 billion (4 trillion yen) following the government’s selection of Oracle, Google, and Microsoft as official cloud providers, says Woodmac.

Japan’s data centre is a gold rush: It is projected that the battle to power a data-driven future’ projects electricity consumption would more than triple from 19 TWh (Terawatt hours) in 2024 to 57 TWh to 66 TWh by 2034. Peak demand from data centres is expected to reach 6.6 GW (gigawatt) to 7.7 GW in 2034, hitting 4% of Japan’s total peak load and representing a threefold increase from 2024 levels.

This surge Energy Window International (Media) understood, would position Japan as the next major battleground for hyperscale data centre expansion, following a similar trajectory to the United States but with a five-year development lag.

“Despite Japan’s steady growth trajectory for hyperscaler investments, data centres account for a significantly smaller share of power demand compared to international benchmarks,” says Naomi Oshita, research associate Asia Pacific power and renewables. “We project data centres in Japan will account for around 4 to 5% of peak demand by 2034, far below the United States, where peak demand from data centres could reach as high as 15% over the same period.”

For Woods, there’s a critical mismatch between demand growth and supply development timelines which now seems like a threat to achieving completion of major projects the massive investment commitment notwithstanding. While hyperscalers according to Woodmac prefer deployment schedules under five years to capture market opportunities, combined-cycle gas turbine projects typically require seven to 10 years for completion.

“This fundamental disconnect explains why infrastructure bottlenecks are pushing major data centre and chip foundry projects to 2029, despite the $28 billion investment commitment from global technology companies,” says Oshita. “Timeline pressure will intensify as demand growth materializes, requiring utilities and grid operators to accelerate planning now.”

Electricity demand according to the new report is expected to be concentrated in the Tokyo and Kansai regions, where data centre developers Energy Window International (Media) prioritize proximity to demand hubs and connection speed over other site factors. According to the report, data centres are expected to account for 7% of the power load in these regions by 2030. However, the gradual rollout of these facilities Woods say, suggests that immediate power shortages are unlikely, as reserve margins remain above 15%.

On decarbonisation challenge intensifies with dependence on fossil fuels, Woods projects coal and gas installations dominating these regions, which also represents over 40% of capacity by 2034 and providing crucial baseload power for consistent data centre operations. “This creates significant challenges for hyperscalers pursuing carbon-neutral commitments while driving the majority of Japan’s electricity demand growth.”

Japan’s renewable energy transition is expected to add complexity to meeting data centre power requirements, Woods said. “The decarbonisation challenge is particularly acute given the scale of data centre demand growth,” says Oshita. “With renewables(solar and wind) reaching only 17% by 2030, Japan will need to accelerate nuclear restarts and renewable deployment to meet both climate goals and hyperscaler sustainability requirements.”

“The question isn’t whether Japan will reach similar penetration levels to the US, but how quickly the power system can adapt to support that growth,” concludes Oshita. “Power utilities are building the plane while flying it, and their business model will look radically different by 2034.”