“If last year was about elections,” says Simon Flowers, “2025 will see the consequences. The new Trump administration will be out to make a mark in global trade, climate policy and geopolitics, all with potentially profound implications for energy and natural resources.”

One is what Simon had called “Brave new world and Trump’s plans for trade tariffs” which according to Simon, pose a serious threat to global economic growth in 2025. At Woods, analysts forecast global GDP growth of 3%, up from 2.7% in 2024. Arguing however that 50 basis points (annualized) could be lost if the US imposes 60% tariffs on China and 10% on the rest of the world, maybe early in 2025, “assuming partial retaliation by major trade partners.” Pointing out hereto its unfavorable impact on commodity demand. Wood’s report further highlights that global oil demand in 2025 would be 0.5 million b/d lower, wiping out half a year’s growth.

And China, Mexico and Canada are likely to lead any potential tariff retaliation, sparking off some kind of a trade war, which may also and inevitably complicate China’s domestic stimulus plans, where the goal is to boost consumption to get GDP growth back to 5% this year.

President-in-Power – Donald Trump it was reported, has promised to withdraw the US from the Paris Agreement, even as global emissions have continued to rise since 2015, “with no major country currently on track to meet its nationally determined contributions (NDC) goals for emissions reduction by 2030.”

“Without the US, the chances of countries raising their NDC targets to put the world on track for a 2 °C pathway or lower ahead of COP30 in Brazil later this year will be remote.”

“With China rapidly decarbonising, peak global emissions may still be in sight. China could choose to pursue its own path as it continues to decarbonise its economy, leveraging its competitive advantages in solar and EVs. We can envisage China announcing a 30% emissions reduction by 2035 in the next NDC submission. It might even bring forward its net zero pledge to 2050 and take leadership in the quest for net zero.

“Delivering peace to Ukraine and the Middle East will be high on President-elect Trump’s agenda as a geopolitical statement. While the challenges are obvious, the peace dividend – not least for the global economy – can’t be overstated. The implications for commodity markets may be less positive. Key commodity exports have continued to flow into global markets through both conflicts (Russian piped gas excepted). Nonetheless, ending the war in Ukraine would reduce investment and trade friction and likely lead to higher supply across most commodities and softening prices. Gas, again, would be an exception with Europe likely maintaining restrictions on Russian imports for some time.”

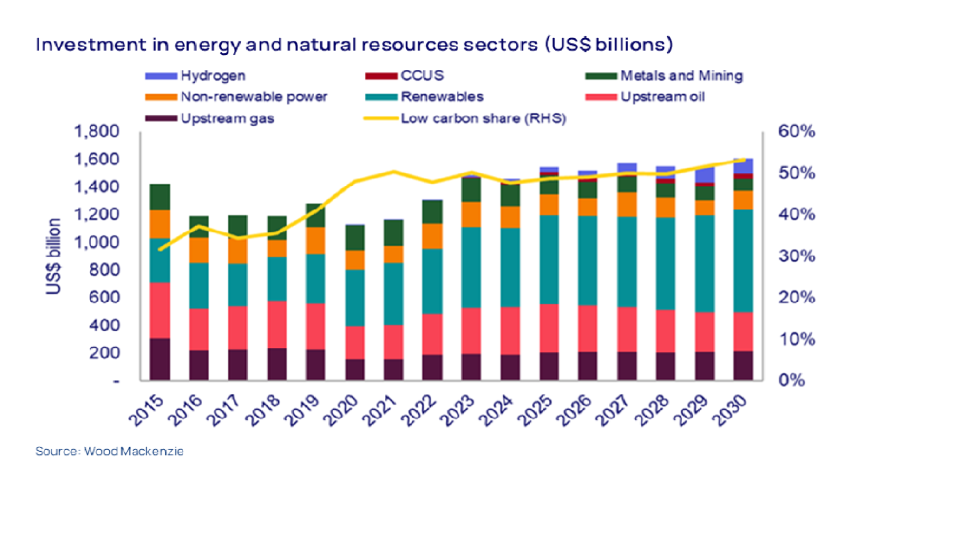

Secondly, and as Simon mentioned, capital allocation and finance, and investment, even in the supply of energy and natural resources, is also expected to reach a record levels in 2025, with spending to exceed US$1.5 trillion, up 6% in real terms in 2024. This headline figure is for capital investment across power and renewables (excluding wires), upstream oil and gas and metals and mining.

It added that while overall spend was increasing, the growth rate would be half that of the early part of the decade. Noting that capital discipline should be the factor in all sectors, reflecting, in part, caution on the pace of the energy transition. The report further highlighted that low carbon’s share of investment climbed sharply from 32% in 2015 to 50% in 2021 before it got stalled. “We don’t expect it to resume an upward trend again until late this decade.”

“To meet therefore the goals of the Paris Agreement, we estimate that low-carbon spend will have to increase by 60% by 2030.”

Power and renewables, the report shows, will continue to attract the largest share of investment, at just under US$800 billion – up 9% – and with 90% of that in renewables. Expenditure on emerging low-carbon technologies is forecast to rise by 50% this year to US$60 billion. More projects are coming through, mainly in carbon capture and storage, with rising costs a threat, particularly in hydrogen.

Upstream oil and gas spend is expected to rise 3% to US$550 billion, the highest since 2018 as financing constraints ease. “We forecast metals and mining investment will slip by 13% to US$140 billion, with weak prices leading to the deferral of nickel and lithium projects a key factor. The industry is clearly not yet buying into the super-cycle narrative.”

Euro Majors, Mergers & Acquisitions come next

Strengthening the core ahead of big M&A may not be taken for granted. Since 2023 the report highlights, oil and gas companies have been actively positioning for a slower-paced transition. US Majors like ExxonMobil, Chevron and ConocoPhillips were reported to have used highly rated equity to acquire US-listed independents, thereby increasing their exposure to stronger-for-longer oil and gas demand. And this is as the final ruling on Chevron’s proposed acquisition of Hess is said to have been slated 2025.

The big questions according to Wood’s analytical team are if, when and how Euro Majors Shell, BP and Equinor will make their own move to strengthen upstream engagements in response. And how much constraint will relatively modest equity market ratings pose, plus the uncertainty around the pool of attractive targets globally, caused by the steady disappearance of many of the “biggest and best” in the global industry play.

“We expect the Euro Majors’ primary goal now is to create financial optionality for 2026. That means their focus this year will again be on portfolio high-grading, cost efficiencies – including more innovative partnerships – driving up free cash flow to boost dividends and buybacks to attain higher stock market ratings. However, a weak external environment could provide an opportunity for a Euro Major to strike out with a transformational corporate deal this year.”

A volatile year ahead for oil, gas and metals prices comes as next.

OPEC+ faces another testing year, says Woods. “The strategy to support price has worked well, but holding Brent above US$80/bbl for the fourth year in a row in 2025 looks very challenging.” Woods believe that the ongoing resilience of non-OPEC supply has left OPEC+ still holding 6 million b/d of supply off the market. “We don’t expect much of a window for more OPEC+ oil again in 2025,” hence the forecast that Brent will slip to an average of US$70 to US$75/bbl. “As we have predicted, it may be several years before OPEC+ can get production back closer to its usual levels of spare capacity.

Natural gas prices look set to be both higher and more volatile through 2025, Wood’s team notes. “With only three major LNG projects in ramp-up all year, the market will be tighter ahead of new volumes arriving in 2026. Faster-than-anticipated drawdown of European storage as cold weather bites and the end of Russian gas transit via Ukraine will pile additional upward pressure on prices, dampening demand in price-sensitive Asian markets.”

Copper prices according to Woods had entered 2025 at US$4.15/lb, 20% below the highs of last May. “We are bullish short and long term. This year, we expect prices to recover, averaging US$4.50/lb – higher than each of the last three years, based on a supply deficit with new mine supply lagging perky demand in the US and China. Beyond 2025, investment in power supply globally to serve datacentres merely adds to the positive narrative of copper’s central role in electrification.”

Power, renewables are firing innovation

Wood Mackenzie has also identified lengthy permitting and interconnection processes as two of the biggest bottlenecks to faster renewables growth in power systems globally. According to them, there are signs already that the penny has dropped and 2025 could be the start of a new era for renewables, citing Germany as confirming the workability of the impact permitting reform, having awarded permits for onshore wind have increased 150% since take-off of the reforms in 2022

“Permitting reform will likely be a big focus for the Trump administration in 2025. On interconnections, the reforms started by FERC in 2023 will begin to have an impact. At least one independent system operator, Midcontinent, will be rolling out new automated software processes that will greatly reduce the two to four years that have been required to complete an interconnection study.”

“Delivering the power to support the proliferation of datacentres will also be front of mind for all governments in 2025, not least the US, where the competition to build them has intensified. Compared with our October analysis, the number of projects we are monitoring has doubled to 100 GW and more US states want a piece of the action.”

“Innovative solutions are emerging to deliver clean power in time to new datacentres. NV Energy’s Clean Transition Tariff enabled Google to take the financial risk on a geothermal project supplied through NV Energy. American Electric Power (AEP) will use natural gas-powered fuel cells to serve datacentres until these can be connected to the grid. Meta will use combined cycle gas turbines to power a 1000-MW datacentre, offsetting the associated emissions with renewable energy credits and contributing to the costs of another carbon capture project. And then there’s nuclear, which continues to gain momentum. We estimate that 11% of the risked small modular reactor nuclear projects aim to serve datacentre demand.”

“An unintended consequence of the datacentre boom over time could be higher US natural gas prices as rising demand squeezes Henry Hub, with a knock-on effect for electricity prices. President-elect Trump won’t want higher domestic gas prices pushing up US consumers’ electricity bills. Like gasoline in the run-up to the November election, electricity prices could become a political hot potato.”

Source: Wood Mackenzie