- Short-term volatility, a new price cycle and Asian demand set future trends

Since the peak of the energy crisis in 2022, the global gas and LNG market has largely rebalanced. Storage levels have remained high for seasonal norms, also courtesy of mild weather. But prices remain relatively high by historic standards, particularly for Europe, and volatility continues to be a persistent feature of the market.

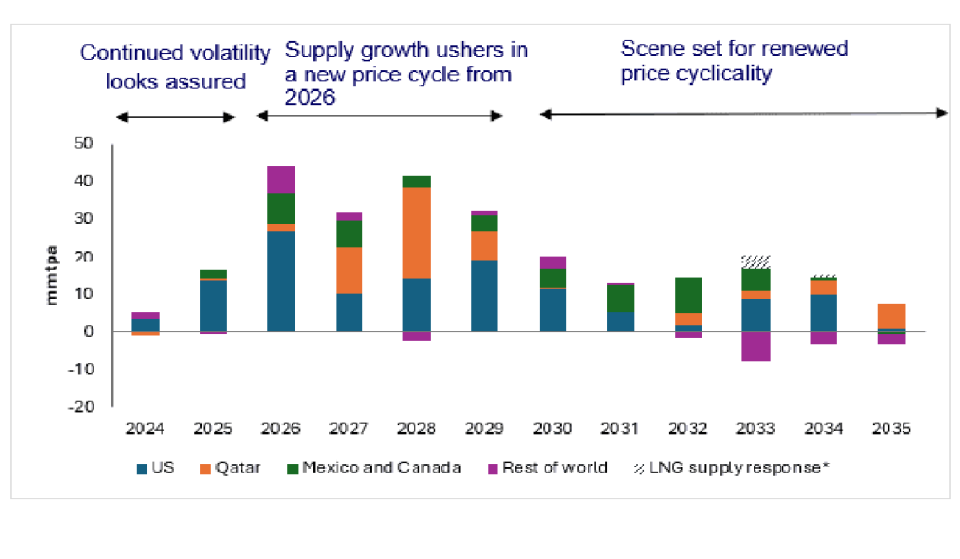

Our recently released global gas Strategic Planning Outlook (SPO) identifies three distinct phases of LNG market growth through the coming decade. First, continued market volatility over the next couple of years as limited supply growth amplifies risk. This is followed by a major wave of new supply, ushering in lower prices from 2026. Finally, as LNG supply growth slows, prices recover again before a new wave of LNG supply triggers another cycle of low prices in the early 2030s.

Continued short-term volatility in the near term looks set to persist

Softer prices since the start of this year have turbocharged demand in key Asian markets. China has been the standout, with LNG imports rising 13% year to date. And through the summer, high temperatures have pushed many Asian buyers to go to the market to purchase additional cargoes. Consequently, TTF is up more than 40% over the past five months, trading well above US$11/mmbtu. As the market grapples with supply risks from Russian supply, instability in the Middle East and LNG outages globally, record European storage levels are keeping a lid on prices.

Looking ahead, rising prices are likely to provide some headwinds to near-term Asian demand growth. But the overall the outlook for Asian demand looks more positive, setting the scene for increased competition between European and Asian buyers. Limited LNG supply growth and the loss of Russian pipeline imports into Europe, as the transit agreement via Ukraine expires, is expected to put further pressure on prices. Storage in Europe might well be at a comfortable level this year, but in 2025 it will be replenished at a slower pace, setting the scene for increased market tightness. The market consensus for the upcoming 18-24 months is for price volatility.

What are the risks? The pace of LNG supply growth and demand across Europe and Asia all provide upside and downside risks. Geopolitical turmoil in the Middle East and uncertainty over Russian gas and LNG exports further muddies the waters, making 2025 a difficult year to call.

Supply growth ushers in a new price cycle from 2026

The sheer volume of new LNG projects under construction will be cheered by buyers following the turbulence of the past few years. With supply growth expected to average above 38 mmtpa between 2026 and 2028, prices will undergo a structural shift.

Lower prices and more supply availability are expected to kick start a new phase of growth for Asian gas and LNG demand, driven by China and emerging economies. But Europe is called upon to absorb more LNG than required, even with Asian demand shifting up through the gears. Nevertheless, European prices will still be holding north of US$7/mmbtu – and Asian prices correspondingly above US$8/mmbtu, meaning that the coming supply wave is far from catastrophic for the market. Our view is that the need for US cargo cancellations to balance the market remains limited.

What are the risks? A muted demand response to lower prices across Asia would undoubtedly draw out the market imbalance. Conversely, supply risks can’t be ruled out. Project delays and an anticipated escalation of Western sanctions on Russian LNG threaten to dent our overall supply growth story, increasing the potential for a “stronger-for-longer” market.

Asia sets the scene for a fresh price cycle in the 2030s

Almost 200 mmtpa of LNG supply may be under construction, but demand from the emerging economies of Asia is only just getting started. We expect a pressing need for additional supply beyond the current wave.

The timing of this new supply now looks less assured. Delays in US LNG investments – due to the DOE’s pause in non-FTA approval – and the time required to develop projects elsewhere will result in supply growth slowing significantly beyond 2029. Markets will respond, with European prices once again above US$9/mmbtu in 2031.

This won’t last for long. A new round of investments through to 2027 across North America, the Middle East and elsewhere results in over 100 mmtpa of new FIDs, with this supply hitting the market in the first half of the 2030s. With European gas demand falling rapidly by this time and Chinese LNG demand peaking, weaker demand growth triggers another cycle of low prices.

What are the risks? – Much will ride on global LNG supply availability and long-term Asian demand growth. Protracted regulatory uncertainties and delays on US LNG developments would push prices higher. Booming power demand and a push away from coal makes gas and renewables the obvious choice in Asia. But if LNG prices are too high, Asia’s most price sensitive buyers could quickly return to coal. A more balanced market will be needed for the LNG industry to continue to grow at pace.

Source: Woodmac