By Ejekwu Chidiebere

Africa RystadEnergy’s latest energy projections confirm, is set to play a crucial role in the global gas industry in the coming years as the world’s liquefied natural gas (LNG) production capacity soars from 486 million tonnes per annum (Mtpa) last year to 755 Mtpa in 2030. The “explosive” growth is expected to be triggered by rising gas demand in regions with limited local production or access to pipeline supplies. Africa is hosting, Energy Window International (Media) has learnt, about 20% of the 477 Mtpa total —around 93 Mtpa— of global LNG capacity in the pipeline, comprising under-construction projects, and confirmed final investment decision (FID) or pre-FID.

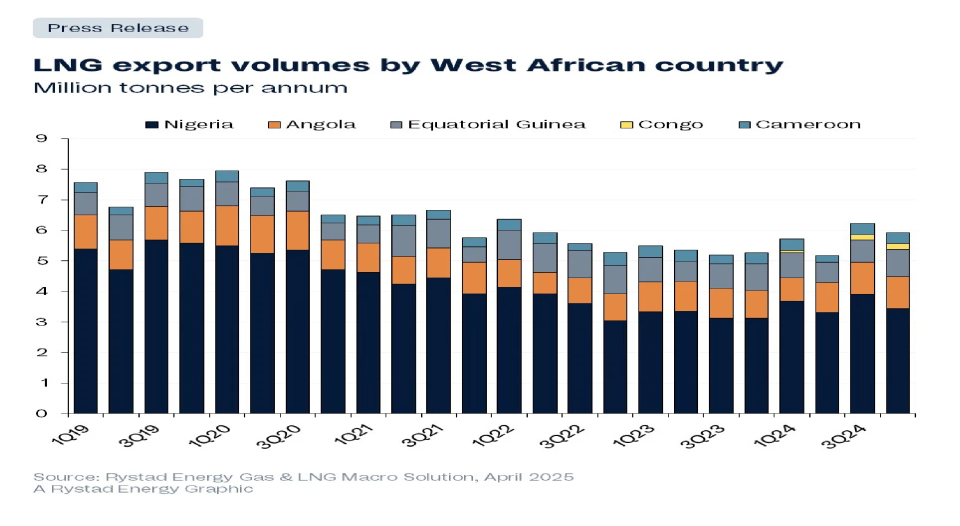

Antonia Syn and Laura R. Skaug reported that Western Africa, led by Nigeria, produces nearly half of the continent’s LNG, thus Rystad Energy forecasts that the country’s LNG exports will rise 20 million tonnes (Mt) by 2030. However and according to them, Nigeria will need to explore alternative solutions such as floating LNG (FLNG) and smaller-scale mini-LNG projects so as to fully capitalize on the abundant gas resources to satisfactorily meet both export and domestic demand.

While emphasizing the urgent action to capitalize on the country’s competitive edge and advantage, RystadEnergy says it has great concerns that production issues and vandalism have continued to pose a major obstacle to country’s annual liquefaction rates which have now dropped from an average of 90% in 2018 to 60% last year, which also shows the extent of the disruptions.

Stressing that as home to the highest concentration of FLNG infrastructure in the world, which also underscores its growing importance in the global gas market, the continent can capitalize on the current onshore LNG production capacity of approximately 70 Mtpa, accounting for around 14% of the global total. The report describes Nigeria as a crucial factor within the Sub-Saharan axis, producing more than half of the region’s LNG last year while targeting a 50% increase by 2030. “At the heart of this growth is Nigeria which contributes nearly two-thirds of West Africa’s LNG output and over one-third of the continent’s total —cementing its role as a cornerstone of Africa’s LNG ambitions on the global stage.”

Antonia Syn, Commodities Markets analyst at Rystad said: “Nigeria has consistently ranked among the top LNG producers globally, despite export volumes being much smaller than those of the US, Australia and Qatar. Nigerian LNG, which is positioned outside the ongoing US tariff war, offers crucial flexibility for Asian and European buyers thanks to its strategic location and shorter transit times compared to US LNG exports. However, ongoing pipeline vandalism and oil theft continue to hinder Nigeria’s ability to fully capitalize on its resources. While we expect Nigeria’s LNG exports to recover, they are unlikely to place the country among the top five global exporters in the near future.”

“Notwithstanding Nigeria’s declining LNG production which has also reduced West African exports in recent years, the country still contributed more than 60% of Africa’s LNG exports last year—a total of 22.7 Mt.” With the new liquefaction projects which according to the report are coming online, West Africa’s production capacity may reach 50.6 Mtpa by 2035, volumes which will come through onshore developments in Nigeria and Gabon, along with various FLNG projects that are set to begin in the next decade.

Energy Window International (Media) gathered that West Africa’s gas resources consist of about 65% offshore and 35% onshore. “The onshore sector is more developed, with over two-thirds already in production or development. Conversely, nearly two-thirds of its offshore gas —around 16 billion barrels of oil equivalent— remain undeveloped. These resources are ideal for FLNG technology, being less dependent on vulnerable pipeline infrastructure.” West Africa according to RystadEnergy holds about 20% of the world’s FLNG capacity at the moment, with potential for further growth if more gas resources are tapped for LNG exports.