- But market drivers may change this scenario as Middle East NOCs look to diversify;

- Energy security issues in China could prompt action from Asian NOCs

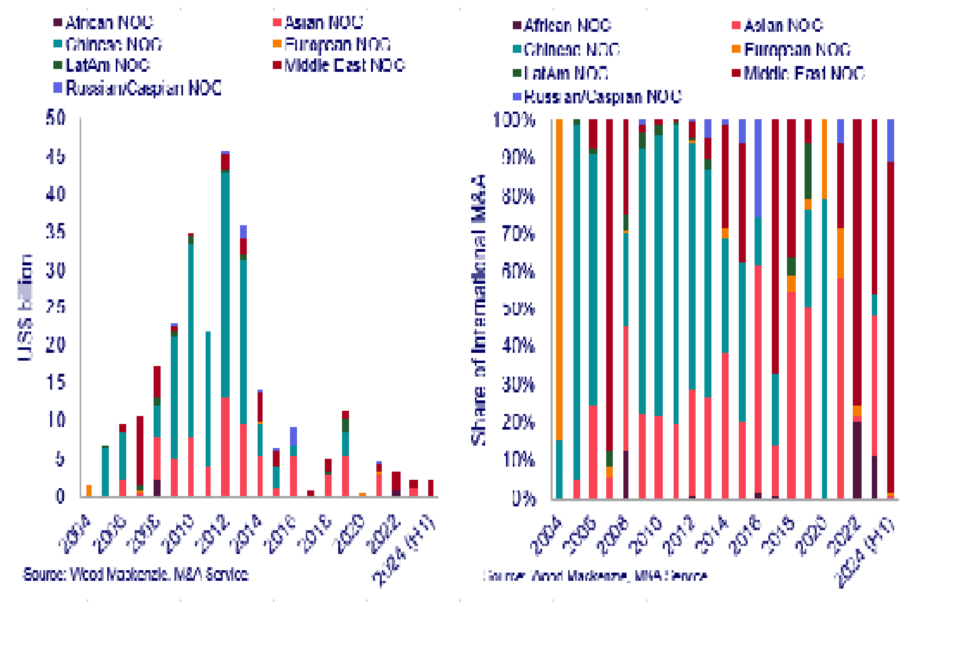

While the mergers and acquisitions market has been recently supercharged by international oil companies (IOCs), national oil companies (NOCs) have sat on the sidelines, with international spending down significantly from highs a decade ago, Wood Mackenzie’s recent analysis has shown.

According to Woods, international M&A spend from NOCs has collapsed from over US$30 billion per year (2009 – 2013) to less than US$5 billion (2019 – 2023), as the peer group’s share of global spend has fallen from nearly 50% at peak to less than 5% today.

“NOCs were once big spenders in international business development, but M&A spend has slumped in recent years”, says Neivan Boroujerdi, Director, Corporate Research at Woods. “However, with M&A valuations attractive and NOCs’ financial ratings at all-time highs, the drivers for NOCs to fill strategic gaps through international business development have never been stronger.

“With (some) NOCs becoming increasingly privatized, motivations for foreign expansion have moved towards those shared by IOCs in terms of portfolio competitiveness and sustainability. We could see several NOCs take advantage of international opportunities to expand, especially those from Asia and the Middle East.

“We don’t expect a return to the heady days of the early 2010s as geopolitical barriers continue to limit potential, but there has never been a better time for host governments to align corporate and country drivers and return to international business development.”

Woodmac’s account further indicates that the Middle East NOCs are growing oil and gas capacity and – as a group – will be producing more in 2050 than they are today.

“Middle East NOCs are well-placed to out-last other producers, but they do have areas of relative weakness, with portfolios overwhelmingly concentrated towards either domestic oil or gas – significantly more so than other NOC peer groups,” says Boroujerdi. “As a result, several have already kick-started Internationalization efforts in search of more diversity. We have already seen Saudi Aramco and ADNOC fast-track entry into LNG and QatarEnergy look to grow via exploration. Achieving critical mass will be the challenge but they have the ambition – and capacity – to do it.”

Accounts show that in Asia, booming populations, expanding economies and coal-to-gas switching will see national energy demand increasingly outstrip local supply. That while these countries are committed to net zero in one form or another, Woodmac predicts an aggregate oil and gas supply shortfall of 13 billion boe per annum by 2030 – up from 9 billion today.

“Despite successful efforts at growing domestic production, homegrown resources are becoming increasingly costly and in short supply. China’s ‘import bill’ is set to rise from 83 billion boe (2000-2025) to 225 billion boe (2026-2050) in our base case”, says Boroujerdi. “Domestic yet-to-find resources and import contracts will help bridge the gap. But overseas resource capture would help hedge against an increasingly volatile environment.”

Deal pricing will remain favorable, looking at the level and frequency with which oil and gas mega-mergers had been reported in the last 12 months, adding that NOCs still have enormous room for further acquisitions.

“Outside of North America, where there’s been a consolidation frenzy, the upstream M&A market is uncrowded”, says Wood Mackenzie’s head of upstream M&A, Greig Aitken. “There were only 200 transactions globally in 2023, that’s the second fewest number of deals in the last 20 years. But there are still a number of material, high-quality opportunities available internationally.”

Aitken continued: “Some of those US corporate transactions have looked expensive, but elsewhere deal valuations remain much more subdued, despite having moved off post-covid lows. But companies across the industry are increasingly re-focusing on oil and gas portfolios in response to a slowing energy transition. As this pivot continues, it’s ultimately going to increase competition for acquisitions and push up deal prices. On that outlook, you want to be a fast mover.”