By Simon Flowers

The WoodMac team were out in force at the just concluded Gastech 2024 in Houston, the gas and LNG industry’s leading conference. Wood Mackenzie is Knowledge Partner for the event, giving us unrivalled exposure to industry leaders, the discussions and debates. Here are our collective high-level takeaways.

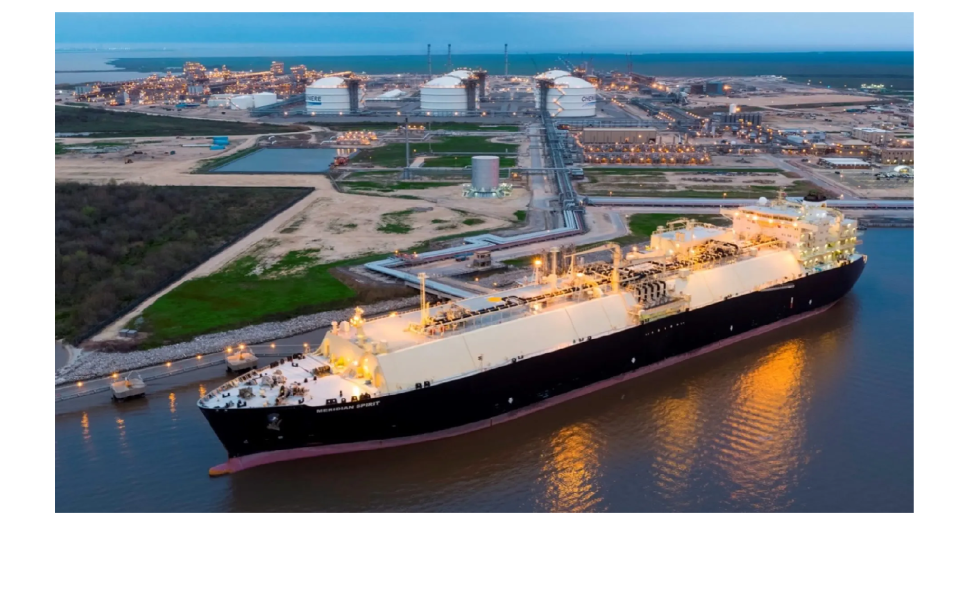

A positive vibe in Houston is a sign of the progress made since Milan two years ago when a subdued industry was grappling with the fall-out of the crisis in Ukraine. The upbeat outlook reflects primarily the robust growth prospects for global LNG, with demand expected to increase by over 50% through the mid-2030s on Wood Mackenzie forecasts. Fading expectations for the pace of emerging low carbon disruptors such as green hydrogen also help. Today the role of gas and LNG acting as an agent of decarbonisation by displacing coal in the power sector through the transition looks increasingly secure. There are, though, clear signals from customers that while price is key, the supply side must evolve to accommodate the need for more flexibility around timing and delivery of volumes.

The message that gas is central to the transition is failing to land with too many stakeholders – from consumers and financiers to the wider populace and even governments. We sense that the industry recognizes the problem but must up its game on communicating the benefits of gas to win over doubters. Cleaner, flexible and more affordable than alternatives should be the mantra. And beyond communication, action – only by adapting to evolving consumer needs, which vary by geography and sector, can LNG truly unlock its growth potential.

Regulators and politics are limiting the potential of US LNG.

Projects with combined capacity of 94MTPA – most of the new supply required to meet global demand growth through the next decade – are pending FID, held up since January 2024 by the Biden Administration’s temporary pause on new permitting approvals for LNG exports. In the meantime, projects elsewhere progress and capture market share, notably Qatar, Abu Dhabi and Canada. While the expectation is that a new administration will move swiftly after November’s election to end the pause, there’s considerable uncertainty about what the new rules will look like. On-going legal tussles between US courts and regulators add to the uncertainty. The US is already the biggest supplier to the market and should be poised to widen the gap with rivals through this decade. But the current political interference, however well-intentioned domestically, along with the legal/regulatory issues cast a shadow over buyers’ perception of the US as a strong and dependable supplier.

LNG trading is set to boom. Already a rapidly expanding segment in the value chain, the exceptional profitability of the dominant incumbents over the last few years is one factor drawing in aspiring LNG traders. Other reasons traders are bullish on the opportunity are the market fundamentals i.e. demand growth; increased liquidity as traditional players beef up their exposure and with the arrival of new entrants (including Middle East NOCs); changing power markets which will rely on gas and LNG to balance variable (and unpredictable) renewables; and market risks (among them threats to supply such as Russia, or shipping bottlenecks in the Panama Canal and Bab al-Mandab Strait). Combined, these factors guarantee persistent volatility, grist to the mill for global traders.

Finance is generally available for LNG projects – our sense was providers of debt and equity are very much open for business. However, raising finance is becoming an increasingly complex pursuit with providers influenced by geography, national politics and ESG/transition positioning. European banks’ appetite to support LNG is still subdued. The result? The process of raising capital for LNG projects has become ever more challenging, often requiring the bespoke tailoring of finance to the specific parts of the value chain to meet the individual needs of the provider. Planning has to start early, but with enough effort it can be done. Worryingly raising financing for projects in emerging markets remains especially challenging because of economics and risks, potentially threatening growth.

Decarbonising LNG isn’t as easy as people might think. The harsh reality is that the economics of decarbonisation, such as including CCS in a project, aren’t attractive as consumers generally don’t want to pay for it. With no return on investment, nobody will fund it, leaving the developer to choose whether to take it on the chin with lower equity returns. The ‘who pays’ dilemma is a major issue yet to be addressed.

Source: Woodmac