“The LNG industry is on a roll. The ‘club’ continues to grow as new buyers swell the ranks. LNG commoditisation is increasing market liquidity, supported by a growing number of traders, hedge funds and NOCs. What’s more, capital remains available for new supply projects and import infrastructure.

“But the pace of future growth can’t be taken for granted. Ahead of next week’s Gastech conference in Houston, we identify three structural challenges that must be addressed to keep the LNG bandwagon rolling. Gavin Thompson, Vice Chair, EMEA, and Massimo Di Odoardo, Vice President, Gas & LNG Research says as he tells the story.

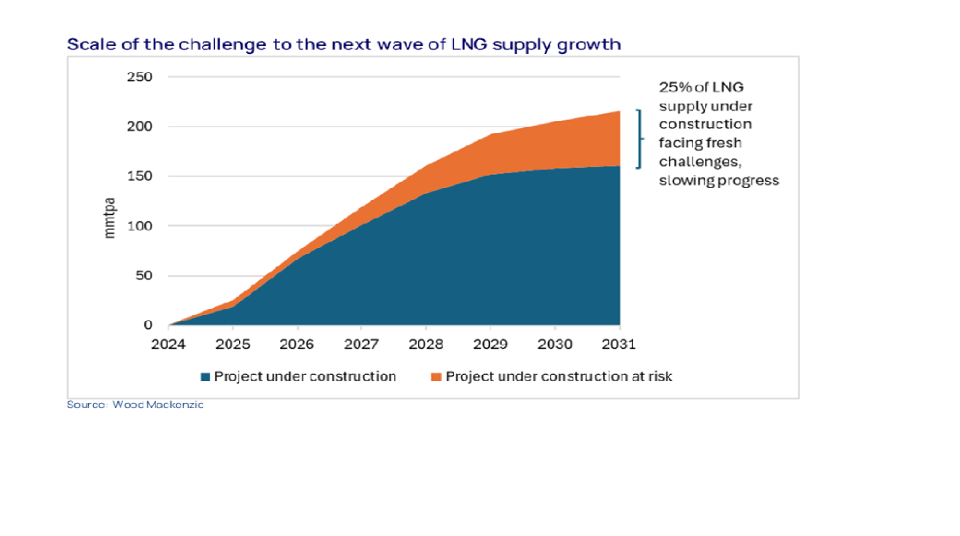

First, the timing and scale of the next wave of LNG supply the market will need to meet demand in the early 2030s, he says, would be jeopardized, with up to 60 Mtpa of facing fresh challenges.

Saying that the US Next Decade’s chunky Rio Grande project faces legal challenges over its existing authorization from the Federal Energy Regulatory Commission. Noting that while construction of Phase 1 is continuing, the court’s decision could impact the timing of project start-up and a final investment decision (FID) on Train 4. Adding that such legal challenges, on a much broader note, may impede US pre-FID projects, thereby compounding the uncertainty created by the Biden administration’s “pause” on export approvals in January. “We expect the pause will be lifted after the November presidential election, but how quickly a new framework for approval will be developed and how it will evolve is unclear.”

With particular reference to the start-up of Russia’s Arctic LNG-2, he says there are indications that the project has continued to prove more difficult than expected, as US and European sanctions bite harder. Maintaining that the future Russian LNG development will struggle to keep the pace. Meanwhile, and according to him, the project development in Mozambique is yet to be freed from political and security challenges, even as supply growth from Qatar and Abu Dhabi is expected to help paste over the cracks. But all things being equal, he believes the timing of the next wave of supply looks less certain than 12 months ago.

Second, future Asian demand growth at the scale anticipated cannot be taken for certain, he posited. “Right now, everything looks rosy, with emerging Asia imports up 15% in the first eight months of 2024. But concerns over supply availability could quickly dent buyers’ appetite. Many key growth markets across Asia remain hugely price sensitive. If supply growth is less pronounced than previously anticipated, then buyer confidence could prove fragile in the much-awaited rebalancing of the global LNG market – when softer prices should help crystallize Asian demand – from around 2026.

“A tighter global LNG market would inevitably keep spot and contract prices higher, making a shift away from coal less attractive for Asian markets. It would also erode the investment required to unlock Asian LNG demand and infrastructure growth potential.

“Third, the LNG industry is facing growing scrutiny over its emissions credentials. Europe is at the forefront, with the methane emissions of all hydrocarbon imports now subject to reporting requirements and potential penalties. An EU tax on all LNG methane emissions cannot be ruled out. Further down the line, we may even see the EU implement a broader tax on all GHG emissions from LNG imports.

“Where the EU is leading, others may follow. The industry should see rising carbon taxes as an opportunity to reduce its carbon footprint, removing any hesitancy around using investment to cut emissions. All companies need to be ready to act. Only by addressing its carbon emissions can the industry build LNG’s credentials as an essential transition fuel.”