Simon Flowers takes a constructive swipe.

The US has a President-elect with power to wield. A likely Republican trifecta would strengthen President-elect Donald Trump’s new administration across domestic and global affairs. Along with the White House, the GOP will have control of the Senate and (probably) the House of Representatives.

President-elect Trump himself has declared he has a “mandate”, although he will be subject to the checks and balances inherent in the US political system. The Supreme Court, with six of its nine justices appointed by a Republican president, is also likely to be broadly supportive of his policy agenda.

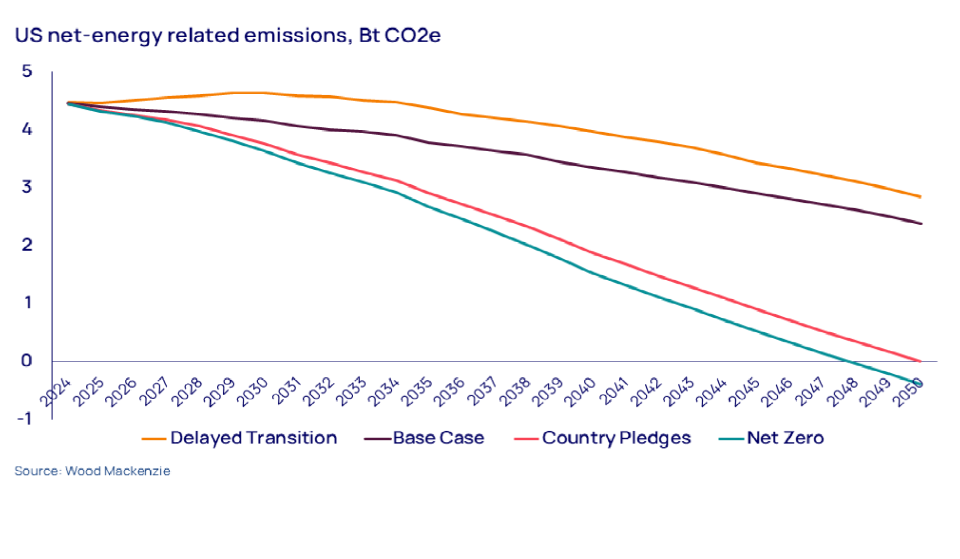

A Trump administration means radical changes for tariffs on imports, climate policy and international affairs. For the energy and natural resources sectors, the implications are many. A pathway nearer to our new delayed transition scenario is now more likely. Here are our team’s initial thoughts.

Power and renewables and decarbonisation:

The US will backtrack on net zero. Bipartisan support for measures in the Inflation Reduction Act (IRA) means that a full repeal is unlikely, but the expiration of tax cuts passed in President Trump’s first term will force Congress to re-examine incentives for low-carbon energy.

Near-term growth expectations for wind, solar, battery storage and EVs rely on IRA incentives, including 10-plus years of eligibility for production and investment tax credits. Even if Congress doesn’t end those credits, various elements of the IRA – including tax credit timelines, financing mechanisms or bonus adders – are likely to be removed or modified.

If those tax credits are phased out, tariffs put on equipment imports and restrictions on permitting, then we estimate renewable deployments could be reduced by a third. The Biden administration’s emissions standards for thermal power plants will be scrapped, although the rules are likely to be the subject of further legal battles.

Prospects for new data centres and factories seeking an electricity supply look better under a Republican administration and Congress, especially if corporate buyers relent on meeting emission reduction goals. We have identified over 51 GW of new data centre announcements since 2023, and manufacturing is set to add at least 15 GW of new demand.

Broad permitting reform to expedite infrastructure development has the best chance in decades. Construction of new gas pipelines, electricity transmission and power plants should be able to respond faster to market load growth.

Support for domestic renewable energy manufacturing is one part of the IRA policy framework that is likely to be relatively resilient. And there’s potential upside for US manufacturers from increased protectionist measures. But if renewables deployment is lower, then that will mean a smaller market for US manufacturers. Plus, tariffs will raise the cost of low-carbon technologies for US consumers, dampening penetration rates.

For vehicles, the new administration is expected to revise tailpipe emission standards from 2027, easing the pressures that were pushing manufacturers towards EVs.

Reductions in support for low-emissions technologies will have implications for metals demand. But reforms of project approvals and a clear definition of ‘critical minerals’ could offer supply upside for large US copper and lithium project pipelines.

Oil market:

Tariffs could slow US and global economic growth, reducing oil demand by as much as 0.5 million b/d in 2025 – one-third of Wood Mackenzie’s current projection for next year’s global oil demand growth. This has the potential to soften oil prices by US$5 to US$7/bbl from current levels, assuming no other risks such as an escalation in Israel-Iran hostilities. Weaker oil demand growth represents a downside risk to the refining industry, but tariff protection should result in US refiners outperforming.

The Trump administration faces a complex and dangerous conflict in the Middle East with the potential to escalate into a full-on regional war. Iran has promised to respond to Israel’s last round of strikes, which could, in turn, provoke Israel to attack Iran’s nuclear installations and oil infrastructure. That scenario could push oil prices sharply higher until spare productive capacity – currently about 6 million b/d – brings more barrels into the market.

Liquefied natural gas:

Of all the energy and natural resources sectors, the US LNG industry will arguably benefit the most from the election outcome. A Trump victory provides more clarity on the industry’s direction, potentially paving the way for much-needed investments to help maintain more affordable global LNG prices post-2030. But the route ahead won’t be all smooth sailing.

President-elect Trump has promised that, on his first day in office, he would end the Biden administration’s pause on new LNG export permits for sales to countries that do not have a free trade agreement with the US. Inevitably, it will take time for the Department of Energy (DOE) to re-staff and satisfy requisite legal and environmental reviews, despite Republicans’ likely control of both legislative branches. New permits might only be issued after the spring, enabling projects to FID in the second half of the year.

But some risks remain. The Trump administration will have limited influence on the lawsuit that threatens to vacate FERC approval for the Rio Grande and Texas LNG projects. And while President-elect Trump might well shelve the soon-to-be-published DOE study on the environmental impact of the US LNG industry, environmentalist groups will likely step up legal efforts to stop projects, possibly leveraging the study itself. Trump’s economic manifesto also poses a risk. Proposed import tariffs could make US LNG exports a target for retaliation while the anticipated increase in domestic gas prices could still prompt second thoughts on how much additional LNG should be exported.

US upstream oil and gas:

A second Trump administration emboldens support for expanding domestic oil and gas production, but it’s unlikely to spur additional growth anytime soon.

Familiar Republican rhetoric such as “drill, baby, drill” resurfaced during the election campaign, and the president-elect even discussed opening new supply geographies previously inaccessible. However, for the large public E&Ps that control half of the US Lower 48’s rigs and develop much of the best leasehold, it’s the return of capital frameworks that will dictate investment. And increased tariffs threaten to expose the industry to cost inflation.

There will be some positives. Policy adjustments to streamline well permitting could encourage more niche onshore drilling on federal land. A new Republican administration may also attempt to overturn a lower court’s ruling in order to preserve legacy Gulf of Mexico permitting laws that are currently under review.

For private US Lower 48 producers, in particular, conditions to raise fresh capital could improve because investors perceive less terminal value risk under an oil- and gas-oriented Washington. And if corporate M&A becomes more streamlined, a build cycle of new private E&Ps could support some activity growth in the coming years.

The president-elect has been relatively outspoken about emissions regulations and we expect some rollback of the EPA’s new oil and gas framework. However, many E&Ps have already undertaken considerable self-regulation, as they did with their drilling activity, to lower their scope 1 and 2 emissions.

US economy:

President-elect Trump has pledged to hike tariffs on imports to at least 10% globally, with a more penal 60% rate for Chinese imports. The tariffs could be enacted early in 2025 by executive order, supplanting existing trade agreements.

In the short term, increases in domestic production to substitute for imports will be minimal. Shifting trade patterns, especially to reduce imports from China, will be material. But with tariffs rising for all trading partners, import costs will increase.

We estimate raising tariffs could cost an additional US$450 billion in import duties in 2025, a burden that US businesses and households would carry. And this is before any global retaliation.

While President-elect Trump is promising corporate tax cuts to compensate, gambling on aggressive protectionism is unlikely to pay off. We expect higher inflation, higher interest rates and higher debt.

Geopolitics:

US-China competition is set to remain the defining strategic relationship of the 21st century, as President-elect Trump’s tariff plans make very clear. His trade strategy is aimed not just at rebuilding US manufacturing industry, but also at strengthening US military capabilities and influence relative to other countries, especially China.

He will withdraw the US from the Paris Agreement on climate and possibly the UN Framework Convention on Climate Change, symbolic of his rejection of international efforts to limit global warming. The result is likely to be a more fragmented picture of global climate policy, with different countries and regions pursuing varying strategies to reduce emissions, rather than attempting to forge a global consensus on action. The US voice at the upcoming COP29 discussions will carry much less weight.

On the campaign trail, Trump had pledged to bring peace to Ukraine and the Middle East. He can be expected to attempt to defuse international tensions by putting pressure on Ukraine to agree a peace settlement with Russia and will also try to broker agreements in the Middle East.

However, he remains a staunch supporter of Israel and will be expected to ramp up pressure on Iran with tougher enforcement of sanctions.

Source: Wood Mackenzie